This blog will store my Mutual Funds analysis snapshots.

This activity started on Dec 26, 2023 to support my own mutual funds investment through year 2024 and beyond. While I have moved my level of investment expertise from a Dummy to Intermediate level, it is my desire to grow as a mentor to the Dummies as I strive to reach the next level of expertise called "Dog".

As one becomes expert in investments, there is a desire and ability to beat Mutual Funds return. But, one needs to be disciplined like any professional money manager for the same. Therefore, this analysis is useful not only for the dummies and intermediaries, but also to the dogs and dog wannabes.

This analysis will get more sophisticated as I evolve ahead. Idea is to store all the snapshots of the analysis, so that bothe the analysis evolution and market transformation can be captured.

As new snapshots arrive, they will be added to the blog, by pushing the old snapshots down. This intro will remain at the top.

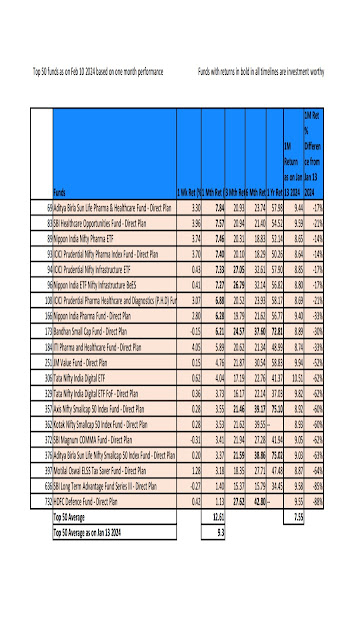

Feb 10, 2024:

Top funds based on one month return as on Feb 9 2024:

1. From this week, the comparison window is for four weeks i.e. 28 days. The baseline date is therefore Jan 13, 2024 like last week analysis, except the time window is moved from 21 to 28 days.

2. The IT stocks recovered and bank stocks declined thru this week, hence we can see the impact on top funds rankings.

3. Though indices corrected through the week, the top 50 funds one month return average raised to 12.61% when compared to 10.49% thru last week. This gives further assurance that top 50 funds tend to do bette than other funds when indices are corrected downwards. Of course, there will be churnout in top 50 funds on weekly basis, hence new investments chasing top 50 funds per recent performance and also consistnecy of performance across other timelines (3M/6M/1Y) is likely to give better returns ahead.

4. Superior fund performances for 1M and above are highlighted with Bold. Please consider superior perfomances not only in 1M timeline, but all other higher timelines, for the investment decisions.

5. 21 funds have been knocked of from top 50, when compared to last 28 days window.

Feb 3, 2024:

Commentary:

1. Top 50 funds based on superior one month return are tabulated. Their performance across 3M/6M/12M give clarity as to consistency of performance.

2. After the top 50 funds, the funds which were in top 50 as on Jan 13, 2024, i.e. three weeks back are also listed. This gives an indication of churn out on top 50 funds. From next week, it will be comparison with top 50 against 28 days.

3. This list is useful for fresh buy decisions. One can consider the superior performance across all time lines for consistency of performance, superior performer returns are in bold.

4. Also, among the ones exiting top 50, two funds still have superior one year return and one fund has superior 6M return.

5. This analysis gives me further confidence that one can aim 40-45% annual return on new investment on top consistently performing funds, assuming market remains bullish like this.

6. Comparison of funds performance in your own investment portfolio will help you to identify the average and below average performers, and therefore will help you to come to Hold and Sell decisions as needed.

7. I do challenge all the mutual fund investors to aim at least 30% annual return, and likely a 45% superior return, by being vigilent on performance, for the current market conditions, which have not changed from bull market.

8. Among the top 50, I do say that, those funds with superior return on all time frames 1M/3M/6M/12M can be treated as darlings, and can be monitored beyond, for further investments in future. Obviously, I am ignoring the performance beyond 1 year for this analysis.

9. Also, it is possible that some darlings may fall of top 50 temporarily, so patience to hold them for at least three months after the fall from grace for sell decisions if not hold decisions.

10. This year we first saw the wave of IT funds, then the pharma, PSU & infrastructure funds, now the PSU Bank funds too. IT funds have lost shine, pharma too a bit. Curious as to what will come next. Certain index funds are consistent winners.

Jan 27, 2024:

MF one month return analysis as on Jan 27, 2024:

1. A new measure is pursued, which is the average one month return of top 50. Last week, it was 6.24, where as it is 7.35. The weekly return of Nifty 500 through last week was -1.11%, where as this top 50 funds overall performance differential was (7.35-6.24)/6.24 = 17.78%. This should not be a surprise, as the top performing funds should do better than the broader market performance. It is difficult to say whether this happens always (see the next point). In support of this data, another observation is that only 10 MFs fell from top 50 this week, where as lot more fell off thru previous analysis.

2. Only 2 among top 50 have shown more than 10% deviation on weekly negative returns (Red color). 17 (yellow) have remained in -10% to +10% range on weekly returns. Whopping 31 funds (green) gave more than +10% return while broader market corrected slightly.

3. The above two points reconfirm return on investment for this analysis further. It is good to note that average annual return based on last one month return for these top 50 is around 85% even after two weeks of broader market dip. It is hoped that as an individual mutual fund investor, one learns to achieve at least half of these returns on portfolio level, though that can not be promised yet.

4. Also, an open issue for an individual is that, if a major correction is around the corner, should one churn out low performing funds to move the money towards better funds, at the risk of 15% short term gain tax payment. The opportunities of better returns plus impending losses on potential correction need to outweigh this 15% short term gain barrier. I personally will look at my portfolio thru next weekend, for exit after budget news. I will look for at least 1:2 risk reward for such a move, meaning, I should gain 30% more on the funds released for the rest of the year (14 months actually as new investments need to be held thru next financial year) ahead. And, if I make this move, I will give at least one month window to wait for fresh investments as the timing of major correction nadir, if out there can not be perfectly timed.

5. Attempting the similar observation for the previous week, the broader market based on Nifty 500 corrected by 1.39%, the average change in top 50 was (6.24-6.8)/6.8 = -8.3%. What this means is that when the broader market direction changes, top 50 mutual funds performance is more highlighted initially (meaning correct more, or enhance more when compared to broader market), but then the top 50 funds catch up with the new trend and remain superlative in performance when compared to the broader market. Again, it is pending as to we can confirm this for all iterations of correction begin.

6. Hence, when we anticipate a correction, it may or may not make sense to hold up against fresh investments, if the fresh investments are targeted to the latest top 50 performing funds. Since the broader correction tends to happen over multiple weeks, and one can not anticipate the amount of correction, it is hard to guess the impact on recent investments. The corollary, which is when the broader market takes off, its impact also is spread across multiple weeks, and mutual funds will typically do well irrespective of benchmark against broader market moves. A more firm trend for correction can be analysed when we complete at least a one month differential of top 50 funds performance over a major correction, which may or may not happen to be available by Feb end.

7. Therefore, it is fair to say, that it is ok to continue to make fresh new investments into top performing mutual funds when the correction is mild (which is the case so far). But, my intuition says that it may be worthwhile to withold new investments if the correction anticipated is bit severe. I intuitively anticipate severe correction through February, and I could be totally wrong, but I have decided to hold off on new Mutual fund investments since Jan 13th .in spite of weekly detailed analysis.

8. With this week’s data, now we have three weekly data extract of one month returns. From next week, the analysis will shift to 28 days performance difference for the top 50. This way, we will get a clear picture of which funds are falling off from the top 50 on a monthly basis almost. Also, it is possible to highlight which funds came into top 50 on a monthly basis almost.

9. Like to make an observation on house affliation of top performing funds:

This week ending Jan 27, 2024: Quant - 14, ICICI Prudential - 7, Motilal - 4, Nippon-4, ABSL - 3, Bandhan - 2, Mirae-2, Mahindra-2, Invesco-2, Tata -1, Taurus -1, Samco-1, ITI/JM/Kotak/Edleweiss/Axis /SBI/UTI- 1 each, Other (CPSE ETF) - 1.

Similar observation for the week previous ending on Jan 21, 2024:

Quant - 13, Motilal -7, ICICI Prudential - 5, ABSL-3, Bandhan-3, Nippon-3, Mahindra-2, Axis/Edleweiss/HDFC/ITI/JM/Kotak/LIC/Mirae/SBI/Tata/Taurus/UTI-1, Other (CPSE ETF)-1

No wonder, one of my friends’ response to my analysis was that, just load your new investments to all top Quant funds and forget about it. Ha..Ha..

10. For some reason, Value Research includes CPSE ETF alone in the mutual funds list, while the investment to the same needs to be done like an ETF stock with the broker, hence there was some delay in my investment to it due to confusions. While I have witheld new investments to top funds here since Jan 13th, I could not help investing into this ETF finally (too little, too late, as its one year return as on this week is 84% and still ranking first), and hope to hold and gain thru budget week in early Feb. Wonder, whether this too will correct significantly post budget news, as when the correction mind sets, biggies like to shave off on the top performers too, only to re-enter quickly at lower levels.

11. Hope to find better grounding on more impacting inputs to monthly fresh MF investments next week, as the analysis will move to 28 days window than 1 week window. We needed these three weekly snapshots so far to get ready for it. So, pls. Look forward to next weekend analysis.

Your further analysis, insights, recommendations pls.

Jan 21, 2024:

Top 50 funds with best one month return are picked up and then compared with the similar list last week.

1. The funds falling from top 50 are shown in red, after the first fifty lines. Most of them belong to IT funds, though other types too are there.

2. Very few funds have done better than last week, most of which are new entries to the top 50.

3. This analysis is more useful to do, after major market event like this week, where corrections came around IT stocks and HDFC Bank.

4. Plan is to store weekly snapshots, and make last one month performance comparison, when the situation warrants.

5. Some of the funds survived in the top 50 due to better performance before, we can anticipate significant churn out in the top 50 whenever major market event occurs.

6. It is safe to say, that among top 50 funds based on one month return, those who have equally better performance over last one year, their superior peformance trend continues.

7. Please note that this top 50 is not a recommendation to invest, rather an aid to understand the churnouts in performance of top funds.

Jan 13, 2024:

Since all my previews analysis were based on Money Control website, which omits many important fund data, it is fair to say, that please ignore all my earlier analyses. This analysis is based on Value Research which is far more reliable.

Jan 07, 2024:

Dec 27, 2023

Edit of Baseline snapshot on Dec 27, after adding three JM funds per certain reader feedback:

Dec 26, 2023

Baseline Snapshot as on Dec 26, 2023: Limited to Equity Funds only given the bullish nature of the market for now

No comments:

Post a Comment