Friday, March 29, 2024

Top Funds with best 1Y return through the financial year 2024

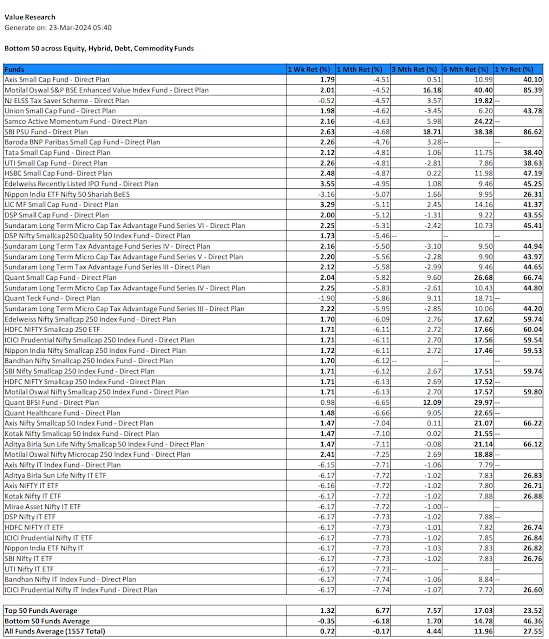

Top and Bottom 50 funds based on last 1M performance as on March 29, 2024

Friday, March 22, 2024

Top 50 and Bottom 50 Funds based on 1M performance as on March 23 2024

Saturday, March 16, 2024

Top 50 and Bottom 50 mutual funds based on last 1M Return across all types of funds - As on March 16, 2024

5. As per the current trend, one can park excess money in top performing commodity funds, for returns superior than fixed deposits.

6. We do not know as to how long and how deep this bearishness will cast on equity funds. May be, equity funds will pop in top 50 after one or two weeks, or not.

7. We get one more chance of Top 50 and Bottom 50 report before this financial year ends for any liquidation of existing mutual fund investments for tax purposes. I am not making any recommendation as to such decisions as I may not be qualified for the same, and also it depends on one's investment strategy. For example, one committed to the Systemic Investment Plan will continue to make regular payments and get more units for those payments due to reduced NAV of such funds.

8. But I am very clear as to my investment approach. Looking at the bottom 50 funds report, the smallcap and microcap are way too underpeforming, and it is unlikely that they will see a reversal soon, and if there is any reversal, then we can see so in the weekly analysis ahead. Since I have next 15 days to liquidate some of my existing MF investments for FY 2024 tax adjustments, I am going to liquidate all pure play small cap and micro cap funds fully, because I will keep this money in the sideline to reenter when they start popping up in the top 50 performance again. Also, given the financial year end and no projection of quick revival of smallcap and microcap, many people like me going for liquidation can create a run on the bank condition on such funds, so we may find worse performance of these funds through next two weeks before things become better for them. Again, this is not what I am asking you to do, as a disclaimer.

Friday, March 8, 2024

Top 50 Mutual Funds based on 1M Return as on March 8, 2024

1. Market is correcting on midcap and smallcap, certain large caps are taking the top benchmark indices to new level. So, we can expect major churn out in the top 50. Since the commodities like Gold and Silver are doing well, commodity funds have popped up into top 50, but they should be considered as a replacement for FD and not equity. Hybrid and debt funds dint make it to top 50 funds list yet.

2. The weekly list of top 50 funds is useful for the fresh investments. Since, the average of top 50 funds across different timelines is given at the bottom, one should consider consistent performance across all timelines, which is basically having the return higher than top 50 averages across all the timelines. Such funds are bolded this time.

They are as follows:

- DSP Nifty PSU Bank ETF

- HDFC Nifty PSU Bank ETF

- ICICI Prudential Nifty PSU Bank ETF

- Kotak Nifty PSU Bank ETF

- Nippon India ETF Nifty PSU Bank BeES

- CPSE ETF.

3. If one wants to compromise on below average of top 50 returns on 1w or 1M levels, a dozen more funds look reasonable, even in the list of funds going out of top 50. For example, Quant Large & Midcap Fund came short on 1M return, but has good 1W return, so it may be a candidate to consider, else, if large cap rally continues, it might make it to top 50 next week.

4. Since Gold and Silver are in the up move, one can start considering such funds as a replacement for FD. In such case, I find Axis Gold ETF having better returns across all timelines, beating FD returns.

5. As guessed last week, Quant Fund family is getting impacted with the latest market dynamics in the sense that not a single fund made it to top 50 this time.

6. The various averages at the end are very useful to summarise the market action, across lat 1 week, and last 28 days. As one can see that average returns are fading across all timelines, when compared to last week.

7. With market dynamics being very volatile now a days, this weekly report based on top 1M return is becoming more and more useful for fresh investment considerations and to readjust Mutual fund return expectations based on new market dynamics.

8. I am bit disappointed that certain hybrid funds could not make to the top 50 list. This is becasue, the aggressive equity portion in such funds were impacted by the midcap and smallcap corrections, so much so that other thematic funds did better to come into top 50.

9. As the market dynamics change, new funds are being launched with new themes. Some of such funds keep popping up in top 50, but with no 6M and 1Y track record. One can take risk on such funds too. For example, ICICI Prudential Nifty PSU Bank ETF does not have a track record beyond 6M returns, but all the returns upto 6M timeline are good, so can be considered, hence, I have already included in my list of investment elegibilities by making the fund name bold.

10. Remember, for your monthly investments, you get to see this kind of weekly report four times, so you can stagger your monthly fresh investments across four weekly reports. Last week, Quant Infrastructure Fund made it to the eligibility by having above average returns in all the timelines, but it has fallen from the top 50 this week, with below average returns both on 1M and 1W timelines, but it does not mean that investment made last week was a mistake. It might return to top 50 in weeks ahead or it might not. So, focus every week is about new investment focus, and not to second guess on prior investments.

11. For myself, the performance target benchmark is half of the top fund return for 1Y. In this report it is CPSE ETF which has given 106%, half of which is 53%. But the top 50 average 1Y return this week is 49.55, which means that there is a risk of not achieving my previously set benchmark, if the market volatility continues. In such case, I will settle for 70% of top 50 average = 70%.49.55 = 35% for now. Please note that the benchmarks will keep changing as market dynamics shape up week to week.

Friday, March 1, 2024

Top 50 Indian Mutual Funds based on 1M Return as on March 1, 2024