Commentary:

1. From this issue onwards, Top 50 is distinguished not only for the entire MF universe (aaprox 1500 plus), but also for each fund category i.e. equity, hybrid, debt and commodity. Comparisons of averages across various tables give further insight as to what is happening in the market fron the MF investments perspective.

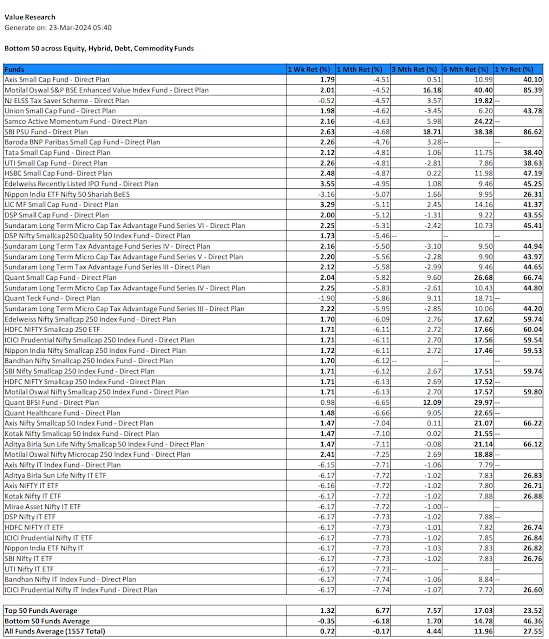

2. Looking at Top 50 funds across all types, the average performance is ahead in all timelines except for the 1Y period. What this means is that the correction on equity funds has been effective enough to take the shine on performance till 6M timeline. But, when we compare the averages of bottom 50 funds against the funds universe average, bottom 50 funds still rule in 6M and 1Y category, because the bottom 50 are filled with the best performers of the earlier bull period.

3. Looking at the top 50, the investment worthiness which is to have higher returns than Top 50 average in all the timelines from 1M thru 1Y, the international equity investments make it to the criteria, and none of the domestic equity based funds. Other than the international equity based funds, it is mostly the commodity funds who make it to the top 50.

4. Looking at the bottom 50, though these funds are laggards on 1M performance, many of them have shown nice recovery through the last 1W, but not enough to erase the losses thru the rest of the 1M. So, if recovery continues like the two sessions in this week, we may find some of these funds from the bottom 50 to spring out of bottom 50, if not to the Top 50. We need to see, what kind of funds will make it to top 50 in such a case, will it be hybrid funds, flexicap funds, speciality funds etc.

5. Comparing the top 50 across debt and commodity funds, commodity funds are showing better performance in almost all timelines.

6. Among the hybrid funds, Top 50 are still underperformers against the rest of hybrid funds in the 3M, 6M and 1Y timelines. What this means is that the traditional leaders among hybrid funds have corrected recently more than the rest in the category, which means the multi asset aspect or the arbitrage aspect has not worked much wonder so far against the correction.

7. Bottom 50 is filled with most of the IT funds in addition to small cap and microcap funds.

8. Market behavior thru next week could give more clarity ahead, whether the equity and hybrid funds will continue to correct or not, vs. will there be recovery Vs. will the commodity funds remain attractive for short term.

9. Personally I have withdrawn 70% of my mutual fund investments through this week at the risk of short term capital gains tax and exit loads. This is because, personally I like to protect my capital short term till the market bullishness around equity is reestablished, which could be within next 15-60 days, and then I will have funds to re-enter with vangience. I am anticipating some recovery through the rest of the March, which could be given away again in April due to Fourth Quarter result disappointments. I could be wrong here, but one needs to take a stand at the risk of being wrong. I also made fresh investments into Gold Funds, (SBI and Axis).

No comments:

Post a Comment