Commentary:

1. On Dec 13th market session, the Indian equities first corrected significantly, but recovered from that correction, and rallyed further, thus sending a strong bullish signal, both on indices and broader market segment. So, this bullish reversal signal can be leveraged as an ideal time to make post correction significant investment in the Indian equity mutual funds space, for which this report helps further in addition to the Top 50 mutual funds report already released for this weekend.

2. The top left portion of the table above gives the average equity fund returns across all equity funds for different timelines from 1W thru 1Y which is used as a bench mark to compare the returns of individual sub types across each timeline.

3. The left bottom portion lists the 20 sub types and their average returns for all the timelines. The returns if above the benchmark return, then it is marked in green, else red.

4. There are only two sub types which have shown above the average returns in all timelines i.e. 1W thru 1Y, and they are Technology funds and Multi Cap funds.

5. Then, there are some fund types that have given above average return in all timelines except for one.

5.1. Mid cap funds, above average returns in all timelines except for 3M timeline.

5.2. Small cap funds, above average returns in all timelines except for 1W timeline.

5.3. Large & Mid cap funds, above average returns in all timelines except for 3M timeline.

6. The following funds types have been giving above average return for both the 1W and 1M timeline, meaning favorites for ultra-short term:

Technology

Mid Cap

Multi Cap

Large & Mid Cap

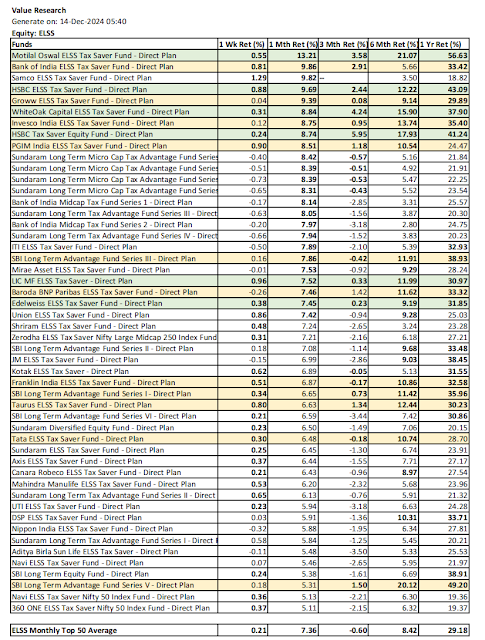

ELSS

Therefore it is fair to say that this analysis will help to find many consistently performing leading funds for further investment.

7. My personal favorites from this report and the previous weekly Top 50 report for further investment in equity funds due to consistency of superior performance short term (1W thru 1Y) are as follows:

Motilal Oswal Nasdaq 100 FOF

Motilal Oswal Multi Cap Fund

Motilal Oswal Business Cycle Fund

Mirae Asset NYSE FANG+ ETF FOF

Motilal Oswal Mid Cap Fund

HSBC Mid Cap Fund

Tata Nifty Capital Markets Index Fund

Motilal Oswal Manufacturing Fund

Motilal Oswal Flexi Cap Fund

Motilal Oswal Small Cap Fund

Motilal Oswal Large & Mid Cap Fund

WhiteOak Capital Digital Bharat Fund

Invesco India Technology Fund

LIC MF Infrastructure Fund

Motilal Oswal ELSS Fund

White Oak Capital Special Opportunities Fund

As one can see, this list is too long meaning one may not be able to invest in all these together, so there is enough choice to make when we pursue consistent perform leaders as the basis for investment, and that is good news.

One can also make Hold and Sell decisions on their portfolio based on the overall performance across all timelines on one's holdings. For example, the Consumption funds lost their shining, and now with the promise of bulls return the Pharma funds are losing shine. I personally churn 20-30% of my holdings to release new cash for more bullish opportunities ahead, it is just my style of investment. (But, my overall equity & equity MF portfolio size is growing from correction to correction).

8. Please note that the returns in certain timelines can be green even with negative return if the benchmark returns too are negative, which is primarily for 3M timeline.

9. The sub types are listed as per their overall return rankings. Overall return rankings are computed by assigning individual ranking for each return by timeline, and then average ranking is computed across the five timelines. The sub-types are sorted per the best to worst overall rankings.

10. The current overall ranking is compared with that from the previous report, which was as on Nov 15, 2024.

The following ranking changes since the last report can be observed:

11.1. Significant ranking improvements: Improvement by more than 5 rankings:

Mid Cap funds

Small Cap funds

Infrastructure funds

11.2. Reasonable ranking improvements: Improvement by within 5 rankings:

Multi Cap funds

Large & Mid Cap funds

Thematic (General) funds

Thematic PSU funds

Thematic Energy funds

11.3. No ranking improvement or degradation:

Technology funds

ELSS funds

Banking funds

11.4. Reasonable ranking degradation: Degradation by upto 5 rankings

International funds

Flexi Cap funds

Dividend Yield funds

Large Cap funds

Consumption funds

MNC funds

11.5. Significanr ranking degradation: Degradation by more than 5 rankings

Pharma funds

ESG funds

Value Oriented funds

12. Detailed returns analysis by fund sub type

12.1. Each fund sub type is listed with funds in descending order of monthly return. Only the top 50 funds are shown if the funds in a sub type are more than 50.

12.2. The consistency of returns of funds are marked in green or amber color as follows:

- Funds with above average return in all timelines within the list are marked in green. Please note that the funds in green too can have negative returns in certain timelines as the average return in that timeline itself is negative.

- Funds with above average retuen in all timelines within the list except for one timeline are marked in amber. For the amber rule, if anyone across 1W and 1M return is above average, then both are considered as above average. If both the 1W and 1M return are below average, they together are counted as below par within one timeline.

- Funds with no return info beyond 1 month can not be green, but only amber - this is to avoid giving green status for spurious ultra short time spikes

12.3. The detailed returns by sub-type by their overall ranking:

12.3.1. Technology Funds

12.3.2. Mid Cap funds

12.3.3. Multi Cap funds

12.3.4. Small Cap funds

12.3.5. Large & Mid Cap funds

12.3.6. International funds

12.3.7. Flexi Cap funds

12.3.8. Infrastructure funds

12.3.9. ELSS funds

12.3.10. Pharma funds

12.3.11. ESG funds

12.3.12. Banking funds

12.3.13. Value Oriented funds

12.3.14. Thematic (General) funds

12.3.15. Dividend Yield funds

12.3.16. Large Cap funds

12.3.17. PSU funds

12.3.18. Consumption funds

12.3.19. Energy funds

12.3.20. MNC funds

13. Whether it is a weekly Top 50 MF report or special MF report, these are availble in the blog indicated below. Blogs are also rendered as videos (on Youtube and Instagram) for those not prefering to read.

Blog: NatsFunCorner! on Blogger

https://natsfuncorner.blogspot.com/

Other relevant Social Network Platform links:

Whatsapp Group: This whatsapp group is a peer group, people active in investment and trading (including day trading) are here, exchanging their insight and views. Please note that there is no room for promotional participation here.

https://chat.whatsapp.com/IuzkVAHgn1jJ20ZmB8m9Vz

FB: https://www.facebook.com/nupadhya/

YouTube: https://www.youtube.com/user/nupadhya

Instagram: https://www.instagram.com/natsupadhya/

Twitter (X): https://twitter.com/nupadhya

LinkedIn: https: https://www.linkedin.com/in/nupadhya/

Disclaimer:

- This is not a solicitation for mutual fund investment nor an advice. It is only an insight to help investment decisions based on the free MF performance data downloaded from Value Research. Investment decisions are only yours to make.

- Mutual fund investments are subjected to market risk. Read the propsectus of a mutual fund for all the risk information associated prior to investment.

- The author can not be responsible for the ommissions or errors in the data from Value Research or the data processing errors if any by the author.

- All your investment decisions need to be based on your decision finally, with no blame to anyone else later.

No comments:

Post a Comment