Commentary:

1. Both equity and hybrid funds corrected through this week.

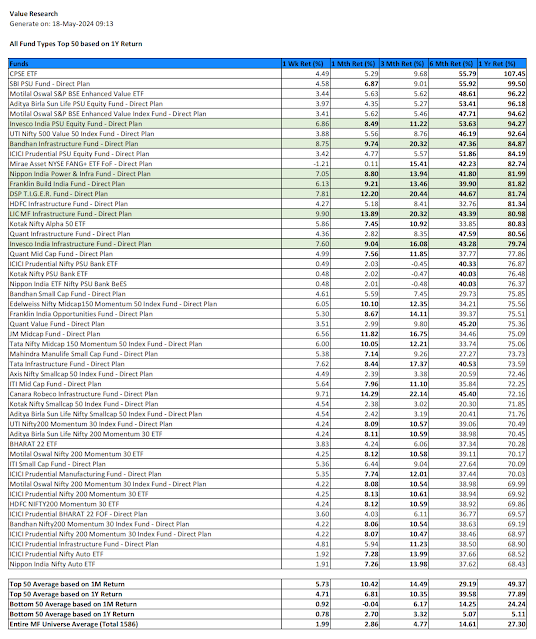

2. Looking at the Top 50 mutual funds across all fund types, good number of commodity funds made to the list.

3. Only two equity funds and and two commodity fund made to the investment grade by having above average return in all timelines 1M thru 1Y.

4. It is sad to see that no hybrid fund makes it to the Top 50 when equities correct, only to restate that the equity portion of the top hybrid funds are not as well managed as the Top equity funds.

5. Looking at the Bottom 50 across all fund types, we can some thematic funds like Private Bank, IT/Digital/Tech, and even some banking /financial funds.

6. Looking at the Top 50 mutual funds across all fund types based on 1Y return, it is pretty much equity funds only. Those which are investment grade for having above average return across all timelines from 1M thru 1Y are marked as green.

7. Please note that Bottom 50 Funds list across all fund types based on 1Y return is being discontinued as there is no utility value out there from that list.

8. Looking at the Top 50 equity mutual funds based on 1M return, the investment worthy ones are marked in green for having above average returns from all timelines from 1M thru 1Y.

9. Please note that there is no separate discussion of Top 50 equity funds based on 1Y return as the list is same as the Top 50 mutual funds across all fund types based on 1Y return, which is given above.

10. The bottom 50 equity funds based on 1M Return is to appreciate what thematic funds are underperforming through last one month, and the list includes some annual performance leaders too.

11. Equity Bottom 50 funds list based on 1Y Return is given to appreciate what equity funds are stuck at bottom 50. One can see the themes of foreign equity, IT/Digital/Tech, Private Bank, and even some Banking/Financial ones here.

12. Looking at the Top 50 Hybrid funds based on 1M return, investment worthy funds are marked in green for having above average returns for all timelines from 1M thru 1Y. Even top 50 hybrid funds corrected through last week while some of the Top 50 equity funds remained positive through the last week.

13. Looking at the Top 50 Hybrid funds based on 1Y return, investment worthy funds are marked in green for having above average returns for all timelines from 1M thru 1Y.

14. Looking at the Top 50 Commodity funds based on 1M return, investment worthy funds are marked in green for having above average returns for all timelines from 1M thru 1Y.

15. It is amazing to see that some of the commodity funds crossed annual return of 30%.

14. Looking at the Top 50 Commodity funds based on 1Y return, investment worthy funds are marked in green for having above average returns for all timelines from 1M thru 1Y.

- Best regards