Commentary:

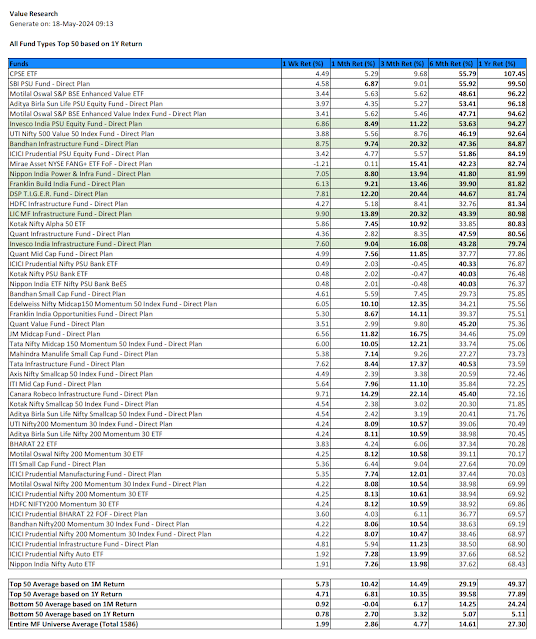

1. Monthly Top 50 Equity mutual funds recovered through this week by a whopping 5.73% sending the monthly return to 10.42%. The annual return of these 50 funds went up to 49.37%, much closer to the approx. 78% annual return of annual return leaders.

2. Commodity funds further gained through this week, pushing the annual return of top 50 commodity funds closer to 20%. Given the silver shot up on the Friday night session, we will see further bull run on commodity funds through next week too.

3. Since the equity is back in the game fully, the top50 funds both for 1M Return and 1Y Return are dominated by equity funds.

4. Those who have been in the sideline for continuing mutual fund investments can now restart and go for further investments. The leadership scenario may be changing, hence the weekly report helps.

5. More and more annual performance leaders have appeared in the Top 1M Return list, which is quite encouraging for new investments.

6. Since this weekly report is a quantitative analysis report, a stringent criteria is used for fresh investments, which is that the funds within the top 50 need to have above average return in all timelines from 1M through 1Y. While this criteria may make some good funds looking not new investment worthy, whatever funds come across as investment worthy are worthy enough to consider. Since there are too many choices, betther go with stringent criteria. This week, the following from the 1M Return Top 50 made the investment criteria:

- Canara Robeco Infrastructure Fund

- LIC MF Infrastructure Fund

- DSP TIGER Fund

- HDFC Defence Fund

- JM Midcap Fund

- HSBC Infrastructure Fund

Bandhan Infrastructure Fund missed out narrowly due to below average monthly return among the top 50.

Many Midcap Funds and some SmallCap funds are appearing back in the Monthly Top 50. This is another sign of correction period getting over for these funds. One can be more confident to invest in these funds ahead.

7. The averages of Bottom 50 too improved through this week. Certain IT / Tech / Digital Funds are still stuck in the bottom 50.

8. Looking at the Top 50 funds based on 1Y Return, the following made to the investment worthiness.

- Invesco India PSU Equity Fund

- Bandhan Infrastructure Fund

- Nippon India Power & Infrstructure Fund

- Franklin Build India Fund

- DSP TIGER Fund

- LIC MF Infrastructure Fund

- Invesco India Infrastructure Fund

9. Please note that the top 5 funds in the list above did not make it to investment worthiness yet as their short term returns across 1M/3M were below average of Top 50. May be, with further recovery ahead, they will reappear as investment worthy.

10. Two of the Auto ETF Funds that made to the investment worthiness through last week report are still showing above average return for 1M and 3M, therefore no regret for those who invested on these last week. It is just that other funds are becoming more attractive through this week due to better recovery.

11. Bottom 50 based on 1Y Return above is more philosophical statement. Nothing strange to note is the good sign.

12. Equity Only Top 50 Funds list for both 1M Return and 1Y Return are redundant, as the Top 50 across all fund types are completely dominated by equity funds.

13. It was bit disappointing that the hybrid funds did not stand out apart from equity funds while equity corrected in the market. This is because aggressive equity portion of the hybrid funds corrected more severely than the better managed equity funds. It is fair to say that equity portion of hybrid funds are not very well managed like Equity funds therefore, as a general statement.

But the good news is that the equity portion of these funds recovered better through this week, as a result the hybrid funds averages on the Top 50 are improving. Also, more Aggressive Hybrid funds are dominating the list, chasing down the balanced and conservative hybrid funds.

The investment worthy funds are marked in green on both 1M and 1Y Top 50 lists above, not discussing their names, as they were similar names like earlier weeks. There is consistency of leadership in Hybrid Funds therefore.

14. Commodties had a good week this week. As a result the return averages further perked up on both the 1M and 1Y Top 50 lists. However very few funds made it to investment worthiness by having better than average returns for all time lines from 1M through 1Y. Since Silver perked up further on the last session (Friday night) we will see some more bullishness through next week, so one can be very confident to invest in the Silver Funds marked as green in the lists above.

15. One caution for the fresh investments in commodity is that there can be correction on commodities in short to medium term. Those who are more confident of jumping the wagon on such corrections ahead can invest aggressively now. 20% annual return promise on commodity funds is hard to ignore otherwise.

16. Debt funds remain boring till intestest rates start falling. It is interesting to note that there is no consistent performance leader in debt funds Top 50 across 1M and 1Y performance. Wonder whether is more of random accounting issue of attaching interest returns. At least one fund in 1M Top 50 made it to investment worthiness, which is more of an academic statement, and not useful for the individual investor.

17. Bottom line, if you wanted the right time to jump back to pump money to Indian equity funds, that time seems to have arrived for now. Better returns may appear in weeks ahead unless there is major global risk appears.

I will make it a point to pump in some more money to some of the funds marked here, early next week.

- Best Regards

Nataraja Upadhya

No comments:

Post a Comment