Commentary:

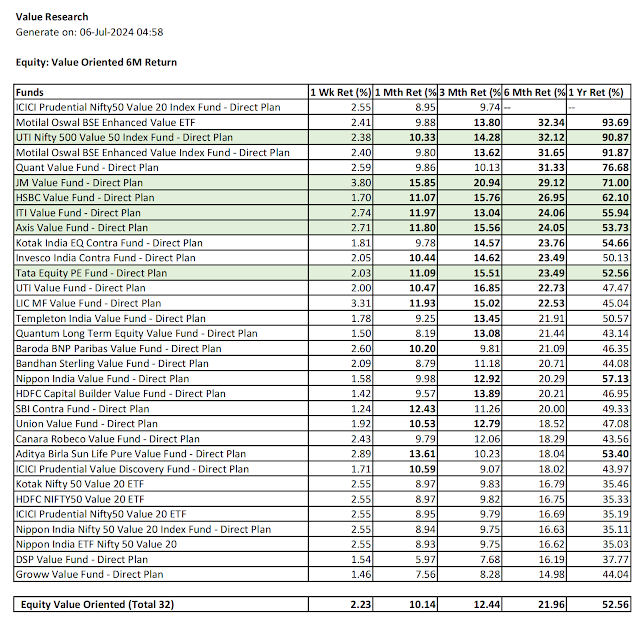

1. This is an observational excercize out of curiosity. The mutual fund performances are compared across the two days, one before the budget news and the one after the budget news. While one can not attribute the key changes across the rolling returns across a day, it is an attempt to assess the overall sentiment of the mutual funds after the budget news.

2. It can be argued that there is minimal correlation between the performance of debt and commodity funds and the budget news. Incidentally, both the fund types corrected across a day on most of the timeframes (except the debt fund returns on monthly basis was bit higher). The correction of commodity funds across a day is shocking, which was actually due to the budget news that the import duty on gold and silver cut to 5%, so the decline was immediate thru the budget day.

3. So, the comparison across the two days need to be done primarily on equity funds and hybrid funds. Here again, the performance of the hybrid funds is impacted due to that of equity and debt portion, both of which corrected through the day with some exceptions.

4. When it comes to the equity funds, the performance correction is out there across the two days, except the following:

4.a. When it comes to the entire equity funds scope across 860 funds, better performance lingered on 6M timeline only. What this means is that the funds that did better in the last 6M fared better post budget news. -

4.b. The monthly top 50 funds gave better returns across all the timelines. What this means is that there has been a specific focus as to the performance leadership post budget news, resulting in better performance of those new performance leaders. We will drill down to the weekly and monthly top 50 list to assess this further.

4.c. The monthly bottom 50 funds gave mixed returns, better returns on 6M and 1Y only, while corrected on other short term timelines. What this means is that the annual top performers corrected further through the day causing this divergence. It is fair to say, therefore that some amount of jumping the ship is happening with annual Top 50 mutual funds investments.

4.d. When it comes to the annual Top 50 funds, the performance deteriorated in all timelines except for the 6M return. What this means is that the funds which did better 6M before suffered more in comparison, which means the recent 6M trendheld up better in comparison.

4.e. When it comes to the annual bottom 50 funds, performance improved on 1W, 6M and 1Y timelines, while it suffered on 1M and 3M timelines. What this means is that the underperformers for the last 1M and 3M fared better in comparison.

5. In summary, the equity mutual fund performances overall suffered a minor correction post budget news.

We will compare weekly leaders across equity and hybrid segments, to assess specific impact on leadership.

6. First, let us compare the weekly Top 50 averages across all timelines across these two dates, one before the budget, and one after the budget.6.a. Weekly averages improved on all timelines from 1M thru 1Y. What this means is that the mutual funds contined their faith in their new focus post budget too. There is not much surprise here which could be also because of the inertia of mutual funds to react fast.

6.b. The weekly performance leaders getting the green status due to above average performance across 1M thru 1Y remained pretty much the same.

Let us do the Weekly Bottom 50 comparison too, for any perspective if any.

7. Comparing the weekly bottom 50 across the two dates, the following observations can be found.7.a. The bottom 50 funds corrected more on timelines 1W, 1M and 3M, they showed better returns on the 6M and 1Y timelines. What this means is that correction hit more on those who were performing better 6M before.

7.b. Both the tables attempt a divergence by highlighting below average weekly return in Bold Red and Above average annual return in Bold Black. Those funds which have both the featurs are marked in Bold Red. While, the pre budget list had only one fund, two more such funds were coming into this divergence list post budget, that too relating to infrastructure and PSU. So, the disappointment on all these three funds is recconfirmed.

8. Overall Summary:

While the overall market sentiment declined post budget news, the most recent performance leaders remained to dominate the performance.

There needs to be caution as to the 6M and 1Y performance leaders to suffer further correction ahead.

The disappointment on Defence, Realty, Infrastructure and PSU can not be ignored.

Please note the limitation of this study is to observe the potential knee jerk reaction over only one day. Mutual funds could be far more lethargic to react than in one day. Also, other factors other than budget might have influenced the results.

Disclaimer:

- This is not a solicitation for mutual fund investment nor an advice. It is only an insight to help investment decisions based on the free MF performance data downloaded from Value Research. Investment decisions are only yours to make.

- Mutual fund investments are subjected to market risk. Read the propsectus of a mutual fund for all the risk information associated prior to investment.

- The author can not be responsible for the ommissions or errors in the data from Value Research or the data processing errors if any by the author.

- All your investment decisions need to be based on your decision finally, with no blame to anyone else later.