Commentary:

1. Given above are the averages of the equity mutual funds by sub fund types.

2. Value Research looks at equity funds into broadly two categories: Sectoral, Thematic and International into one, and then the rest. Hence the averages are given both by these two types and the fund sub types below both these titles.

3. So, when we look at the combination of funds, we get three combinations, all equity funds (854), Sectoral, Thematic and International Combined (357) and the Rest (497). Of course, the 6M reutrn is the best when you look at the Top 50 of all 854 equity funds. But from a comparative study, Sectoral, Thematic and International together gave better Top 50 six month return.

4. When we look at the entire mutual funds scope 6M return average, Rest other than Sectoral, Thematic and International performed better than both all combined and the Sectoral, Thematic and International.

5. The overall ranking of the 6M Average Returns of all fund sub types are given at the extreme right. Thematic PSU funds gave the best returns followed by Sectoral Infrastructure funds followed by Mid Cap funds.

6. The worst 6M average returns were given by the Sectoral Banking (Rank 20) followed by the Sectoral Tech followed by International equity funds.

7. Looking at the Top 50 funds across all equity funds, the ones marked are the green are the ones having above average returns across 1M thru 1Y. They are likely to remain good bets for furrher investments till the trend changes.

8. Looking at the Bottom 50 funds across all equity funds based on 6M Return, the ones with better average monthly return are marked in bold. It is worth waiting to see whether their uptrends will hold further. While these funds will take some more time to be marked as investment worthy (green), at least those holding these can hold longer with hope of better returns ahead.

9. Looking at the combined Sectoral, Thematic and International funds together, the ones marked in green are the those having above average returns from 1M thru 1Y timeline.

10. Looking at the bottom 50 of Sectoral, Thematic and International combined, those with monthly return above the average are marked in Bold. One can hope to see further recovery on such funds, if still holding.

11. Looking at the 6M Top 50 of Rest of the funds combined except Sectoral, Thematic and Internationa, the ones marked in green are those having above average return for all the timelines from 1M thru 1Y.

12. Looking at the bottom 50 based on 6M return on the Rest of the funds combined except for Sectoral, Thematic and Intrenational, the ones marked in bold are those giving above average monthly returns, ones holding these can hold longer therefore in hope of further recovery.

Now follows the 6M Return analysis of all 20 equity fund sub types:

13. Large Cap:

14. Large & Mid Cap:

15. Flexi Cap

16. Multi Cap

17. Mid Cap:

18. Small Cap:

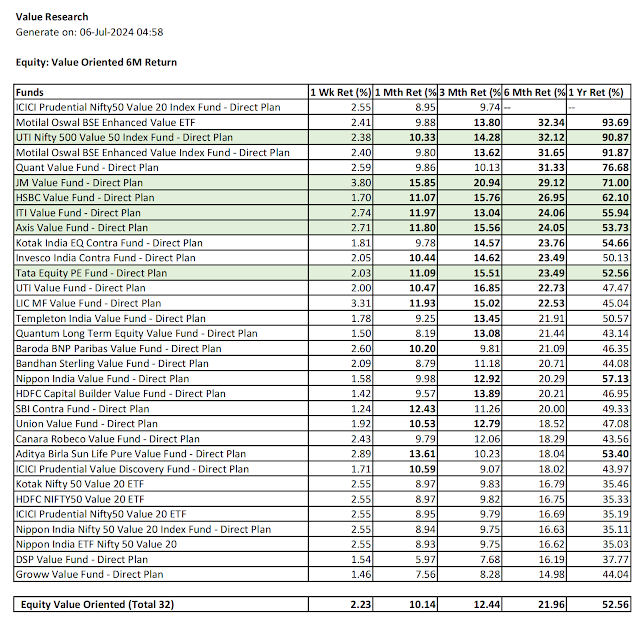

19. Value Oriented:

21. Sectoral - Banking:

22. Sectoral - Infrastructure

23. Sectoral - Pharma

24. Sectoral - Technology

25. Thematic General

26. Thematic Consumption:

27. Thematic Dividend Yield

28. Thematic Energy

29. Thematic ESG:

30. Thematic MNC:

31. Thematic PSU:

32. International:

Disclaimer:

- This is not a solicitation for mutual fund investment nor an advice. It is only an insight to help investment decisions based on the free MF performance data downloaded from Value Research. Investment decisions are only yours to make.

- Mutual fund investments are subjected to market risk. Read the propsectus of a mutual fund for all the risk information associated prior to investment.

- The author can not be responsible for the ommissions or errors in the data from Value Research or the data processing errors if any by the author.

- All your investment decisions need to be based on your decision finally, with no blame to anyone else later.

No comments:

Post a Comment