Commentary:

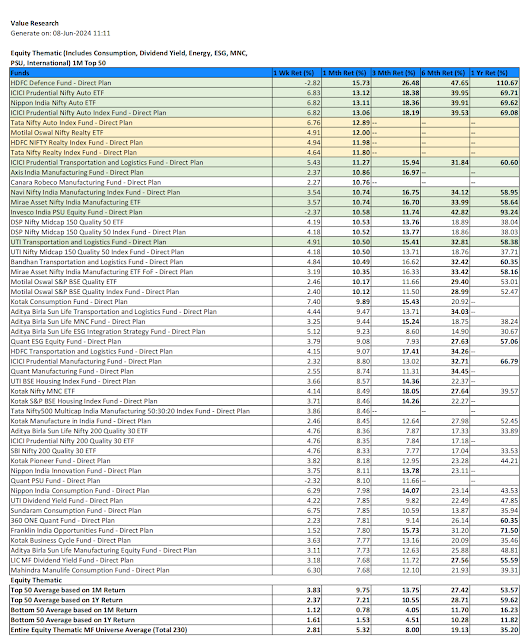

1. All the fund types advanced both for the week and the month on average, except for the commodity funds.

2. Monthly Top 50s made better progress for the week and the month when compared to the annual Top 50s, therefore we can anticpate churn out in monthly Top 50 leaders.

3. Both equity funds and hybrid funds Top 50 for the month and year maintained their average return levels. Hence, overall the equity funds and hybrid funds remained bullish.

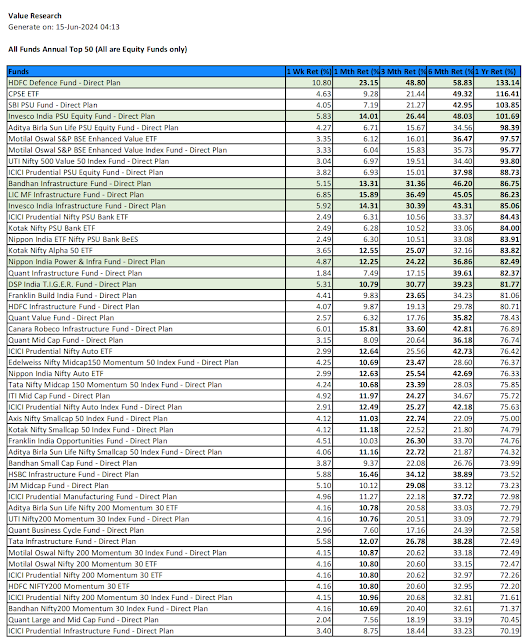

4. Looking at the Monthly Top 50 funds across all fund types, it is mostly equity funds except for one Hybrid fund in the list like last week report. The IT / Tech / Digital funds had remarkable recovery for the week and the month, but given the poor returns thru 3M/6M/1Y timelines, only one fund made it to the investment grade so far. Many Large Cap / Mid Cap / Small Cap funds made to the Top 50 list through this time.

5. With above average returns within the Top 50 across all the timelines from 1M thru 1Y, very few funds made to the investment grade, and are marked in green. There is a definite churn out in leadership here, which means market leadership is rotating across scripts and therefore funds. So, there is a level of unsettling feeling for all except for those marked in green.

6. In contrast, the annual Top 50 across all fund types leadership is somewhat stable, totally dominated by equity funds.

7. The investment worthy ones are marked in green for having above average returns across timelines 1M through 1Y, and these funds belong to defence, infrastructure and power.

8. Looking at the Monthly Top 50 equity funds list, there is only one change which is to replace the lonely hybrid fund with an equity fund when compared to the similar list across all fund types. Hence there is minor changes in the investment grade ones marked in green. Incidently, the Top fund among these green ones is a Mid Cap fund.

9. Looking at the equity Monthly bottom 50, there are many annual leaders stuck here with poor monthly returns, which is a concern as to whether their attractiveness is getting over. As mentioned last week, we better wait for another two weeks minimum before rushing to exit such funds, marked in red in the list. Most of them are either PSU or PSU Bank funds. So watch out for their performance through next two weeks.

10. There is no need to discuss Equity Annual Top 50 funds list separately, as it is the same as the annual Top 50 across all fund types.

11. For the first time, annual bottom 50 equity funds list is given above, mainly to appreciate the type of funds which are recovering from the dump, and are marked in Bold Dark Blue. Can't help noticing the recovery of FMCG, Private Bank ETFs in this list.

12. Top 50 hybrid funds both for the month and year have maintained their usual trends. The investment worthy ones are marked in green for having above average returns across 1M thru 1Y timelines.

13. Commodity funds list remains boring for correction both in weekly and monthly basis. Further, with continued leadership churn out, none of the funds make it to the investment worthiness as there is no consistent above average return across 1M thru 1Y for any fund. So, the old glory is wearing out for all the funds, more for some, and less for some.

Disclaimer:

- This is not a solicitation for mutual fund investment nor an advice. It is only an insight to help investment decisions based on the free MF performance data downloaded from Value Research. Investment decisions are only yours to make.

- Mutual fund investments are subjected to market risk. Read the propsectus of a mutual fund for all the risk information associated prior to investment.

- The author can not be responsible for the ommissions or errors in the data from Value Research or the data processing errors if any by the author.

- All your investment decisions need to be based on your decision finally, with no blame to anyone else later.