1. On average, all fund types except for the commodity funds appreciated, commodities continue to correct.

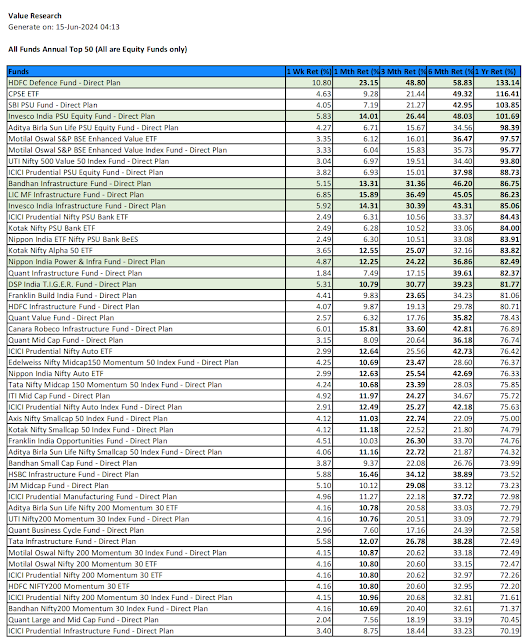

2. Both the Monthly Top 50 and Annual Top 50 funds across all fund types are represented by equity only. This reconfirms the recovery of equity continuing.

3. Looking at the Monthly Top 50 across all fund types, both the weekly and monthly returns are very nice. Investment worthy ones are marked in green for having above average return in all timelines from 1M thru 1Y. The ones marked in the Yellow are also leading ones, except they lack data beyond one month for being new funds. Risk takers can consider those too.

4. Looking at the Annual Top 50 across all fund types, the investment worthy ones are marked in green.

Equity Top 50 Analysis:

5. There is no need for separate Equity Top 50 analysis as equities totally dominated all fund types top 50.

6. Looking at the Hybrid Top 50, hybrid funds appreciated both on weekly and monthly basis, thanks to equity recovery. The investment worthy ones are marked in green.

7. Looking at the Hybrid Annual Top 50, the investment worthy ones are marked in green.

8. Looking at the Commodity Top funds, there is a divergence between weekly trend and monthly trend. There has been significant correction thru last week. Also, going by the global cues, the commodity funds perk up due to inflation fears and war fears, both of which are getting contained. Therefore, there can be more risk than reward in further investment into commodities in near future. Personally, I have sold all my investments in commodity mutual funds as I like to move that amount into equity now, as the equity short term correction seems to be over for now.

Those who rode on the commodities through the last 6 months, that too in the last three months, made good return, 12.64% for three months, 16.26% for six months, which look far better on annual basis, kind of golden era for commodity funds, and that era may be getting over.

Disclaimer:

- This is not a solicitation for mutual fund investment nor an advice. It is only an insight to help investment decisions based on the free MF performance data downloaded from Value Research. Investment decisions are only yours to make.

- Mutual fund investments are subjected to market risk. Read the propsectus of a mutual fund for all the risk information associated prior to investment.

- The author can not be responsible for the ommissions or errors in the data from Value Research or the data processing errors if any by the author.

- All your investment decisions need to be based on your decision finally, with no blame to anyone else later.

No comments:

Post a Comment