Commentary:

1. Since post election bearish sentiments have stabilized to approx. pre-election result levels, it is good time to look at equity funds performance by fund sub types. Similar analysis of hybrid funds too will be done soon.

2. Looking at the averages, the top 50 annual returns are in the following order:

Equity All: 75.59%

Equity Thematic: 59.62%

Equity Large Cap, Large & Mid Cap: 59.30%

Equity Mid & Small Cap: 58.31%

Equity Sectoral: 55.89%

Equity Flexi & Multi Cap: 46.28%

Equity Value Oriented: 41.12%

Equity ELSS: 40.57%

3. For the last one month, the top 50 equity funds returned the following average returns:

Equity All: 10.54%

Equity Thematic: 9.75%

Equity Large Cap, Large & Mid Cap: 8.17%

Equity Mid & Small Cap: 7.95%

Equity Flexi & Multi Cap: 6.73%

Equity Sectoral: 6.87%

Equity ELSS: 6.11%

Equity Value Oriented: 5.55%

4. In order to assess the impact of election results through the last week, the top 50 funds weekly returns by fund types are as follows:

Equity Sectoral: 4.37%

Equity Thematic: 3.83%

Equity Elss: 3.22%

Equity All: 3.19%

Equity Mid & Small Cap: 3.12%

Equity Flexi & Mutlti Cap: 3.01%

Equity Large Cap, Large & Mid Cap: 2.73%

Equity Value Oriented: 2.93%

So, sectoral type equity funds have become more favorable since last one week.

5. Looking at the All Equity Top 50 based on 1M Return, the investment worthy ones for having above average returns from 1M thru 1Y timelines are marked in green.

6. Looking at the All Equity Top 50 based on 1Y retun, the investment worthy ones are marked in green.

7. Looking at the Equity All Top 50 based on average of returns from timelines 1W thru 1Y, the investment worthy ones are marked in green.

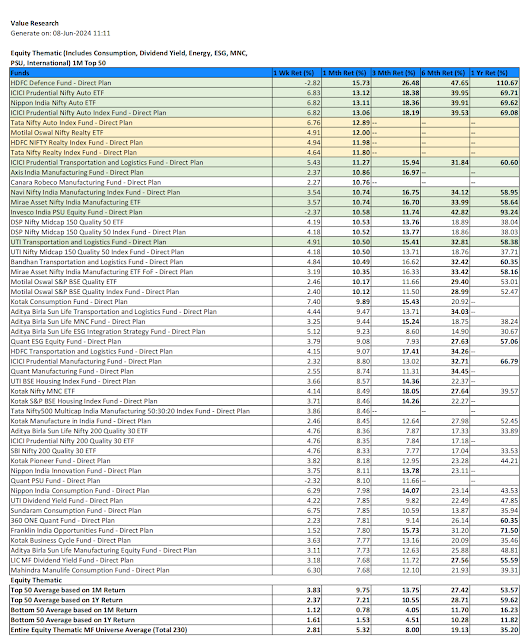

8. Looking at the Thematic Top 50 based on 1M return, the investment worthy ones are marked in green. The ones marked in yellow do not have return info beyond one month for being new funds, and while they have an aggressive return for the last one month, their consistency of performance for longer period needs to be tested.

9. Looking at the Thematic Top 50 based on 1Y return, investment worthy ones are marked in green.

10. Looking at the Top 50 of Large Cap and Large/Mid Cap based on 1M return, the investment worthy ones are marked in green.

11. Looking at the Top 50 of Large Cap and Large/Mid Cap based on 1Y return, the investment worthy ones are marked in green.

12. Looking at the Sectoral Top 50 based on 1M return, the investment worthy ones are marked in green.

13. Looking at the Sectoral Top 50 based on 1Y return, the investment worthy ones are marked in green.

14. Looking at the Flexi Cap and Multi Cap Top 50 based on 1M return, the investment worthy ones are marked in green.

15. Looking at the Flexi Cap and Multi Cap Top 50 based on 1Y return, the investment worthy ones are marked in green.

16. Looking at the Mid Cap & Small Cap Top 50 based on 1M return, investment worthy are marked in green.

17. Looking at the Mid Cap & Small Cap Top 50 based on 1Y return, investment worthy are marked in green.

18. Looking at the ELSS (Tax Saver) Top 50 based on 1M return, the investment worthy ones are marked in green.

19. Looking at the ELSS (Tax Saver) Top 50 based on 1Y return, the investment worthy ones are marked in green.

20. Looking at the Value Oriented funds (only 32 out there), investment worthy ones are marked in green for having above average returns from 1M thru 1Y.

No comments:

Post a Comment