Commentary:

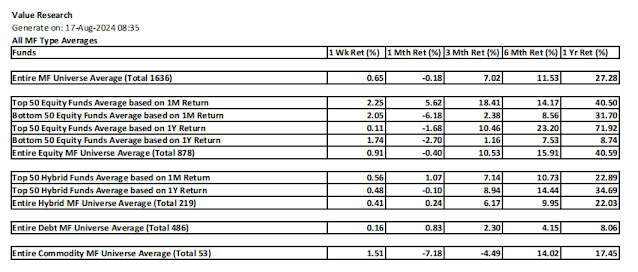

1. All Mutual Fund Types turned positive for the week on average.

2. Equity and Commodity funds gave negative return on average. The debt and hybrid funds on average were positive for the month.

3. The average of Top 50 Equity Funds for the Month was at low of 5.62. But, the annual average of all equity funds came back to above 40%. Average annual return of Top 50 equity funds is at 71.92% which is kind of low.

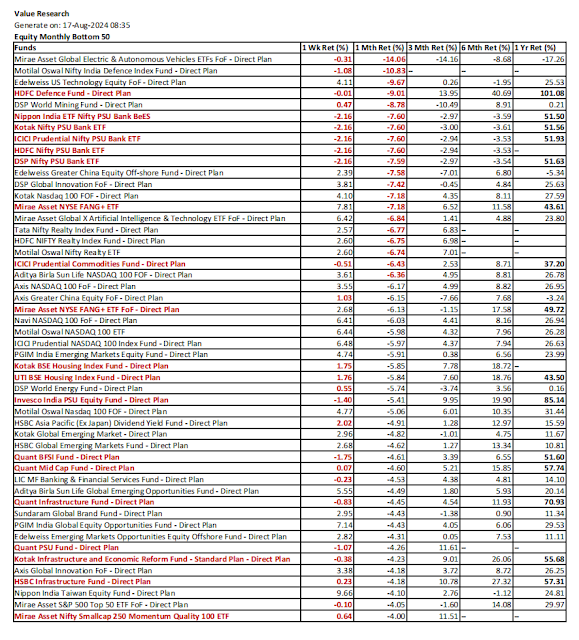

4. Looking at the Equity Monthly Top 50, the one in the green are those with above average return in all timelines from 1M thru 1Y. The one in the amber are those with above average return in all timelines from 1M thru 1Y except for one timeline. Monthly Top 50 list is dominated by healthcare and technology funds.5. The purpose on Monthly Bottom 50 is to identify bearish reversals, which is done by highlighting above average annual returns (In Black Bold) and below average returns on weekly or monthly basis (Marked in Bold Red). The funds meeting this criteria are marked in Bold Red. Notable ones are HDFC Defence Fund, certain PSU Bank ETFs, certain Infrastructure funds etc.

6. Looking at the Annual Top 50, a few ones made it to the green or amber, for having substandard returns from 1W or 1M basis. Bandhan small cap fund made it to the green and stayed positive for both the 1W and 1M basis.

7. The puroose of the Annual Bottom 50 list is to look for bullish reversal, for which above average annual return, monthly return and weekly return are highlighted. Funds with above average annual return and also above average monthly or weekly return are highlighted with Bold. No noteworthy mentions here. However, many Bank ETFs are still stuck here with no bullish reversal sign like last week. So, the bad time continues.

8. By looking at Hybrid Top 50 for both the month and year, one can make investment decisions based on green and amber status.

Disclaimer:

- This is not a solicitation for mutual fund investment nor an advice. It is only an insight to help investment decisions based on the free MF performance data downloaded from Value Research. Investment decisions are only yours to make.

- Mutual fund investments are subjected to market risk. Read the propsectus of a mutual fund for all the risk information associated prior to investment.

- The author can not be responsible for the ommissions or errors in the data from Value Research or the data processing errors if any by the author.

- All your investment decisions need to be based on your decision finally, with no blame to anyone else later.

No comments:

Post a Comment