Commentary:

1. Commitment is to generate a detailed Equity Mutual Fund Returns analysis by monthly, with performance comparisons across Equity Fund Sub Types.

2. There are 20 equity mutual fund sub types. Their average return is given for all the timelines from 1W thru 1Y. Their relative performance rank is also given by timeline. Then at the end, overall ranking is given based on the ranking average from 1W thru 1Y.

3. The fund sub types are sorted in descending order of overall relative performance across all the timelines. The fund types at the top are the most favorite, and the one in the bottom are the least favorites as on today.

4. Top 5 fund types in descending order of overall returns are:

a. Pharma

b. Consumption

c. PSU

d. Mid Cap

e. Multi Cap

5. Bottom 5 fund types in descending order of overall returns are:

a. Large Cap

b. Flexi Cap

c. MNC

d. Banking

e. International (The worst fund type)

6. Average equity fund returns across all the 871 funds are computed and marked in Amber. Within each fund type, the superior return to this average are marked in green and sub par performance is marked as Red.

7. For each fund sub type, the performance rank is marked across all the timelines, with rank number color coded.

8. Refer to an earlier month detailed report for changes since last one month or so, as to the performance and rankings. Please note a minor difference between these two reports which is that this report has the funds sorted by monthly performance, where as the earlier report with link below is sorted by 6M performance.

https://natsfuncorner.blogspot.com/2024/07/special-mutual-funds-report-last-6.html

9. The performance report by sub type follows. Look for 20 such reports below.

Please note down a key distinction which is that the green coded funds are those with above average returns across all timelines, but they do not mean investment worthiness as much they are meant in the usual top 50 funds analysis. The one in the amber are those funds with above average returns in all timelines except for one.

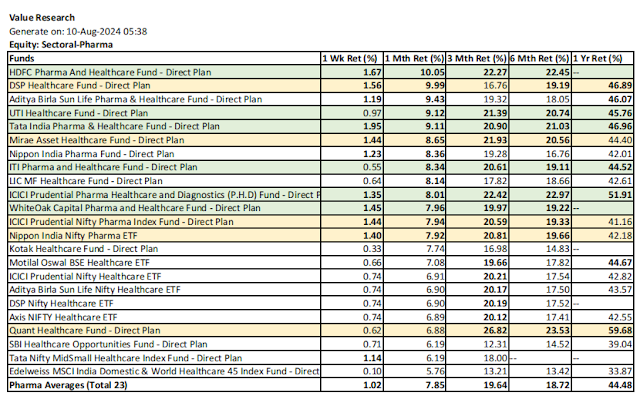

9.1. Pharma

9.2. Consumption

9.3. PSU

9.4. Mid Cap

9.5. Multi Cap

9.6. Energy

9.7. ESG

9.8. Dividend Yield

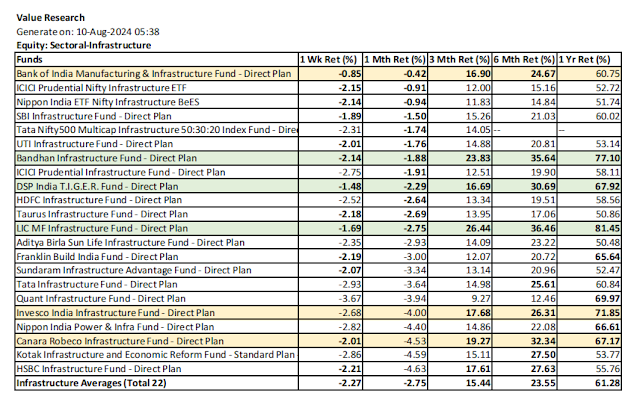

9.9. Infrastructure

9.10. Large & Mid Cap

9.11. Small Cap

9.12. Thematic General

9.13. Value Oriented

9.14. Technology

9.15. ELSS

9.16. Large Cap

9.17. Flexi Cap

9.18. MNC

9.19. Banking

9.20. International

Disclaimer:

- This is not a solicitation for mutual fund investment nor an advice. It is only an insight to help investment decisions based on the free MF performance data downloaded from Value Research. Investment decisions are only yours to make.

- Mutual fund investments are subjected to market risk. Read the propsectus of a mutual fund for all the risk information associated prior to investment.

- The author can not be responsible for the ommissions or errors in the data from Value Research or the data processing errors if any by the author.

- All your investment decisions need to be based on your decision finally, with no blame to anyone else later.

No comments:

Post a Comment