Commentary:

1. This special mid week report was created with the following objectives.

1.1. I felt that the last week's Top 50 report could be a mis-lead as the further bullish behavior could throw out new leaders out there. Now, we have two sessions in this week, taking a dip stick now is a good idea, as we can invest on new performance leaders right away with big money than lose out another three productive trading days, having to wait for the weekend.

1.2. I will be busy this weekend, hence the regular report could be delayed as late as next Wednesday. That way, one is not made to wait for more than a week when too many excitement is there in the market, for good mostly.

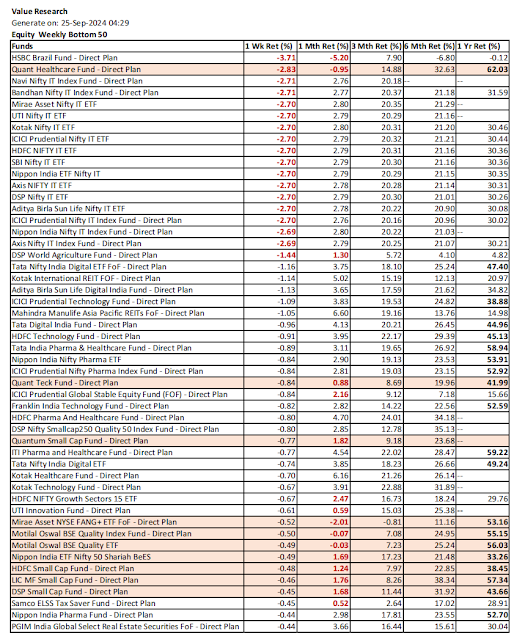

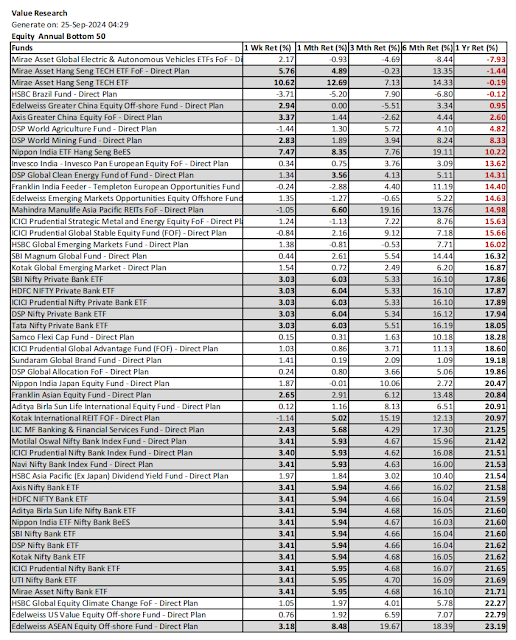

1.3. Since we are in the beginning of a bull run, very short term summary too is importnant to make some investment decisions as the very short term behaviour will become a bell weather for new investment decisions. As a result, for equity we are comparing both top 50 and bottom 50, for all three critical timelines, 1W, 1M and 1Y.

1.4. Since 1W timeline is made critical for this report, we will be considering 1W timeline too for decisions to mark Green and Amber this time.

1.5. Curiosity is there as to how the post US Fed interest rate cut is impacting the other fund types also. While Debt fund Monthly Top 50 list is given out of curiosity, Hybrid Annual Top 50 list is skipped from this report for having less value.

2. Analysing the Equity Top and Bottom 50 summary above, the following insight can be inferred.

2.1. Weekly Top 50 has given ferocious 3.8% weekly return which is equivalent to 52*3.8% = 197.6% annualized return, which is way too attractive, and hence the Weekly Top 50 can be looked into as a Bell Weather.

2.2. Monthly Top 50 monthly return has not improved much, which means there is a leadership churn out here, so we need to see the resulting churn out influencing fresh investments.

2.3. Top 50 annual return for the month is still lower than all equity funds average, which is a concern, which means annual leaders are laggards when it comes to monthly return, but the good news is that they have given better weekly return than overall average, bottom 50 annual have given still better weekly and monthly averages, which means broad based bull run recovery on equity funds, and both the laggards and leaders are improving their returns at annual basis, however the weekly & monthly Top 50 and Bottom 50 is the best telescope to make investment decisions.

2.4. The annual Top 50 annual return has now improved above 70%, which is again a confirmation of bull run impact on a broad base.

2.5. Monthly Top 50 equity funds annual average is bit lower than the overall equity average, which means many past annual under performers are getting into this top 50 list. Looking at the weekly Top 50 annual returns, the presence of past annual under performers is much higher. What this means is that, we need to further discount the role of Annual Top 50 in the investment decisions as a new trend is more dominating right now.

2.6. There is no point in adding all the funds from all the fund types, this work will be avoided going forward, rather fund type level more detailed summary will be given in the future, helping better insights for investment decisions.

3. Looking at the Weekly Top 50, since we are now considering all timelines including Weekly to mark funds in green or amber, funds become green only if they have above average on all timelines from 1W thru 1Y, and amber only if they miss out on one timeline. It is fair to say that though no fund is in green, all these funds in amber are worthy of new investments, at least for short term, say next two months. These funds belong to Realty, Consumption, Auto and Financial Services. So, if this is going to be proven to be a bell weather for short term (need to see in future weeks), we do have an initial indication.

4. Weekly Bottom 50 list is created to look at the very short term under performance leaders and it is filled with Healthcare, IT/Digital/Tech and some SmallCap funds. This is more of a breather from the superior performance than a reversal, but for short term, one need to be cautious on these fund types as they may relatively underperform compared to the new leaders.

5. The one in the red are those with below average weekly return or monthly return within the list, and above average annual return within the list. It is just that their underperformance very short term is far more significant, that is all. Those focused on long term hold may avoid sell and continue to hold, but those with limited funds wanting to do better short term even at the cost of additional tax burden of short term gain may consider selling these funds only to move freed up money to more bullish choices short term.

6. When it comes to Monthly Top 50, the rules for Green and Amber are same as before, which is that Weekly returns are ignored for the same. However, for fresh investment decisions, I will consider both Green and Amber with above average weekly return this time. Some consumption funds are eligible as a result, and they are also there in the Weekly Top 50 with Amber.

7. Purpose of the Equity Monthly Bottom 50 remains to sense the bearish reversal of better performing funds. This time onwards, rule is further refined. In the past, it need to have below average return either weekly or monthly basis in addition to above average annual return. This time onwards, it needs to have both weekly and monthly return below average in addition to above average annual return. With this, a few only will be marked as bearish reversing. Even with such tight rule, HDFC Defence Fund is caught here in bearish reversal mode, though it has positive weekly return, which happens to be below average. What it means is that this fund is still a underperformer compared to many out there. SBI PSU Fund and CPSE ETF escaped this infamy this time due to above average weekly returns, they would have been marked red per old rule.

8. When it comes Equity Annual Top 50, this time the rule for Green and Amber remains the same except for one relaxation which may be carried further ahead. The rule now is that the returns from 1M thru 1Y need to be above average in all timelines for green, and a miss out on one timline allowed for Amber, the new relaxation is that weekly above average return can be considered as a substitute only where monthly returns are below average. As a result, CPSE ETF makes it to the Amber, else it could have missed out. Bandhan Small Cap fund is in Green, but it is slowing down on weekly return. So, the safer bets are those with above average weekly returns also. I might incorporate above average weekly return as mandatory going forward in all Top 50 lists for green status, but giving more margin of under performance for Amber saying any of the above average return across week or month will do. Let me decide on this next report. Based on this, may be I do not need to repeat Weekly Top 50 and Bottom 50 going forward.

9. Equity Annual Bottom 50 is to sense the bullish reversal. Rule is kept the same, which is to have an above average weekly return or the monthly return. Depiction is changed, the concerned funds are marked in grey, indicating they are coming towards being in Black.

10. Above is the Hybrid Top 50 summary, by week, month and year. There is less volitility here unlike Equity funds as to returns. Hence, one Top 50 report is enough, which is the Monthly Top 50 report, the Annual Top 50 will be discontinued. One can notice improvements in the Monthly and Annual Retun averages due to better weekly returns.

11. Looking at the Hybrid Monthly Top 50, the rule for green and amber status, going forward from this report changes in the sense that even above average weekly return is required for Green along with the same for 1M thru 1Y too. But, a relaxation for Amber is that either an Above Average Weekly or Monthly can suffice among themselves to count. No example is available to illustrate this relaxation in Amber rule, so next time.

12. Debt Funds Top 50 summary is given for week, month, and annual. The improvements across are gradual and nothing much to tack about.

13. Out of curiosity, as a one time deal, Debt Monthly Top 50 list is given. The rule for green and amber is the same as that for hybrid, meaning to include weekly return too for green, and some relaxation that only one of monthly or weekly above average is good enough to count for Amber.

14. Since there are only 53 commodity funds, no point in discussing different Top 50 funds here. The new rule for Green and Amber is applied here too like for Hybrid and Debt funds.

15. Whether it is a weekly Top 50 MF report or special MF report, these are availble in the blog indicated below. Blogs are also rendered as videos for those not prefering to read.

Blog: NatsFunCorner! on Blogger

https://natsfuncorner.blogspot.com/

Whatsapp Group: This whatsapp group is a peer group, people active in investment and trading (including day trading) are here, exchanging their insight and views. Please note that there is no room for promotional participation here.

https://chat.whatsapp.com/IuzkVAHgn1jJ20ZmB8m9Vz

FB: https://www.facebook.com/nupadhya/

YouTube: https://www.youtube.com/user/nupadhya

Instagram: https://www.instagram.com/natsupadhya/

Twitter (X): https://twitter.com/nupadhya

LinkedIn: https: https://www.linkedin.com/in/nupadhya/

Disclaimer:

- This is not a solicitation for mutual fund investment nor an advice. It is only an insight to help investment decisions based on the free MF performance data downloaded from Value Research. Investment decisions are only yours to make.

- Mutual fund investments are subjected to market risk. Read the propsectus of a mutual fund for all the risk information associated prior to investment.

- The author can not be responsible for the ommissions or errors in the data from Value Research or the data processing errors if any by the author.

- All your investment decisions need to be based on your decision finally, with no blame to anyone else later.

No comments:

Post a Comment