Commentary:

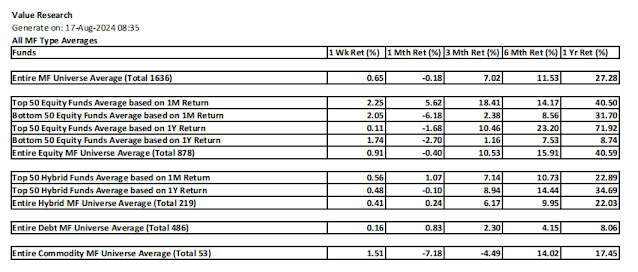

1. The mutual funds did well last week across the board. The monthly average return of Top 50 Equity mutual funds is now bit subdued at 6.12% Top 50 Equity Annual Return is at 74.01. Overall annual average return of all equity funds is at 43.23% Annual Return Average of Equity Monthly Bottom 50 being more than that of Equity Monthly Top 50 is an indication of confirmation of change in leadership of superior returns short term.

2. Looking at the Monthly Top 50 Equity funds, the one in the green are those with above average return within the list for all timelines from 1M thru 1Y. The one in amber are those with above average returns in all timelines from 1M thru 1Y except for one timeline. Leadership of healthcare funds continues with some decline, but the Tech funds are more pronounced this week on their recent leadership. The two darlings from last week, HDFC Pharma fund and Bandhan SmallCap fund still remain in the green.

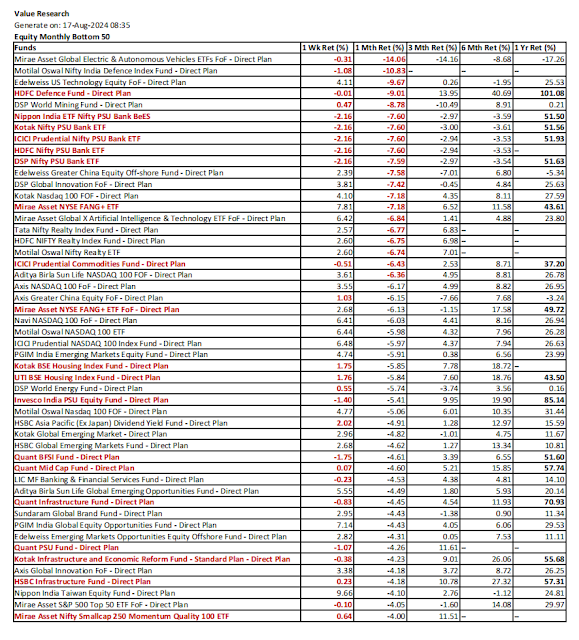

3. Purpose of Monthly Equity Bottom 50 list is to recognize potential bearish reversal of certain better performing funds. The above average annual return within the list is marked Bold Black, the below average weekly and monthly returns are marked Bold Red. Funds with above average annual return and below average weekly or monthly return are marked in Bold Red, indicating them as potential bearish reversal candidates. HDFC Defence fund still appears here, and one can see the erosion of its annual profit further. The other in the red belong to Infrastructure, PSU, Power, Realty, Manufacturing, Consumption, Large & Mid Cap. So, caution on these fund types.

4. Looking at the Annual Top 50, there is significant erosion as to the green status in the list given to sub par performance of many of the annual leaders. LIC MF Infrastructure Fund and Bandhan SmallCap Fund are shining bright with green status.

5. The purpose of the Equity Annual Bottom 50 list is to recognize the potential bullish reversal. The annual Returns is delinked for this computation. Any fund with above average weekly or monthly return within the list is marked in Bold Black. Looks like Nifty Bank ETFs are finally recovering, and their annual return percentage is also going up, but they are still in the bottom 50, so remain a watch item.

6. There is some churn out in the Monthly Top 50 leadership with green status on Hybrid funds. Bank of India Mid & Smal Cap Equity & Debt Fund in the green list has the highest annual return and is more favored.

7. Quant funds fail to make the green list in both the Monthly Top 50 and Annual Top 50, inspite of past good annual returns. So caution ahead.

8. There is lack of consistent leadership among Commodity funds, no fund made it to the green list.

9. You can anticipate this blog weekly, as well as the special MF reports in all of my social network platforms. These blogs are also rendered as videos for those not prefering to read.

Blog: NatsFunCorner! on Blogger

https://natsfuncorner.blogspot.com/

Whatsapp Group: This whatsapp group is a peer group, people active in investment and trading (including day trading) are here, exchanging their insight and views. Please note that there is no room for promotional participation here.

https://chat.whatsapp.com/IuzkVAHgn1jJ20ZmB8m9Vz

FB: https://www.facebook.com/nupadhya/

YouTube: https://www.youtube.com/user/nupadhya

Instagram: https://www.instagram.com/natsupadhya/

Twitter (X): https://twitter.com/nupadhya

LinkedIn: https: https://www.linkedin.com/in/nupadhya/

Disclaimer:

- This is not a solicitation for mutual fund investment nor an advice. It is only an insight to help investment decisions based on the free MF performance data downloaded from Value Research. Investment decisions are only yours to make.

- Mutual fund investments are subjected to market risk. Read the propsectus of a mutual fund for all the risk information associated prior to investment.

- The author can not be responsible for the ommissions or errors in the data from Value Research or the data processing errors if any by the author.

- All your investment decisions need to be based on your decision finally, with no blame to anyone else later.