Commentary:

1. There has been some leadership churn out among the debt funds since the last detailed report (as on Aug 25, 2024). Further, the leadership churn out is still out there going on.

2. The biggest stand out is the slippage of ranking of Other Debt funds which are basically the US bonds based funds to the last rank, and the ascendance of the Credit Risk Funds to the top rank.

3. Further, Credit Risk Funds is the only fund category with above average return in all timelines when compared to overall debt fund returns across all sub-types.

4. Concern is that among the Top ranking debt fund types (namely Long Duration, Dynamic Bond, Medium Duration), the short term returns (returns for the week or/and month) are below the overall average, so these are watch items further, as their longer term returns could be further impacted ahead.

5. The detailed returns analysis by sub type.

Only the top 50 funds are shown if the sub-type has more than 50 funds.

The funds marked in green are those with above average return within the list for all timelines from 1W thru 1Y. The funds marked in amber are those with above average return within the list for all timelines from 1W thru 1Y except for 1 timeline. One exception to the rule for amber is that both 1W and 1M timelines are considered as one timeline, where if anyone among them is above average, then both considered as above average.

The detailed return analysis by sub-type is presented below based on its overall ranking order below.

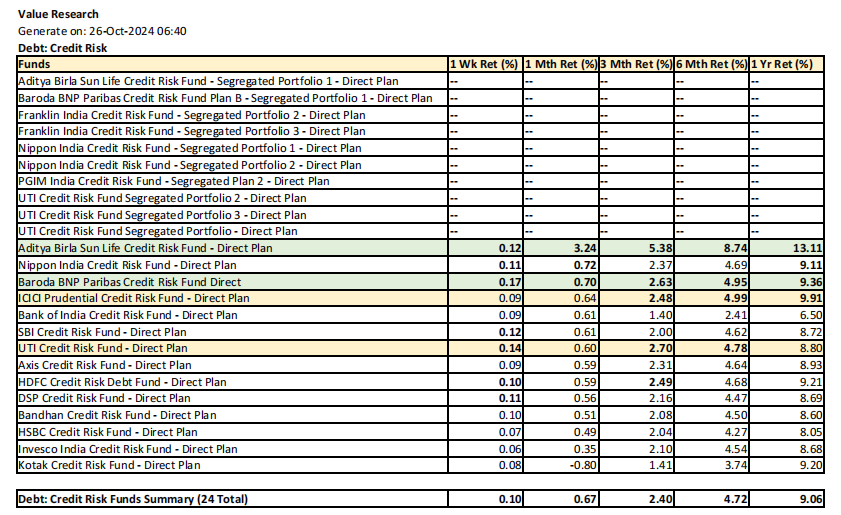

5.1. Debt: Credit Risk Funds Summary (24 Total)

5.2. Debt: Long Duration Funds Summary (9 Total)

5.3. Debt: Dynamic Bond Funds Summary (30 Total)

5.4. Debt: Medium Duration Funds Summary (22 Total)

5.5. Debt: Floater Funds Summary (12 Total)

5.6. Debt: Gilt Funds Summary (31 Total)

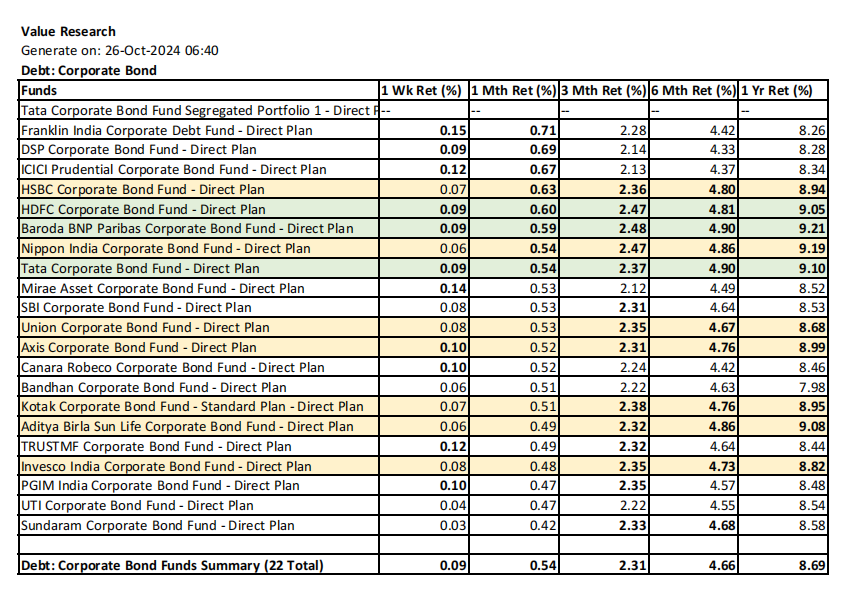

5.7. Debt: Corporate Bond Funds Summary (22 Total)

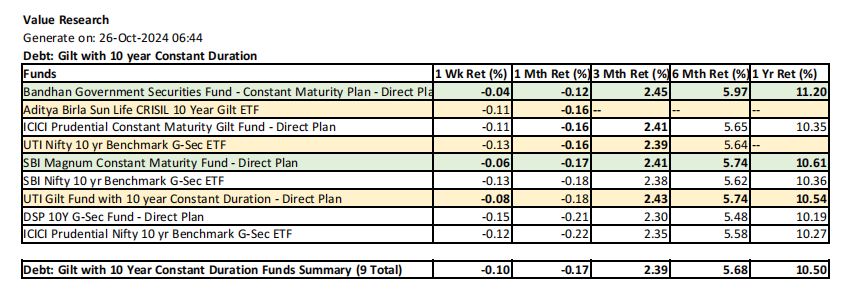

5.8. Debt: Gilt with 10 Year Constant Duration Funds Summary (9 Total)

5.9. Debt: Medium to Long Duration Funds Summary (15 Total)

5.10. Debt: Target Maturity Funds Summary (106 Total)

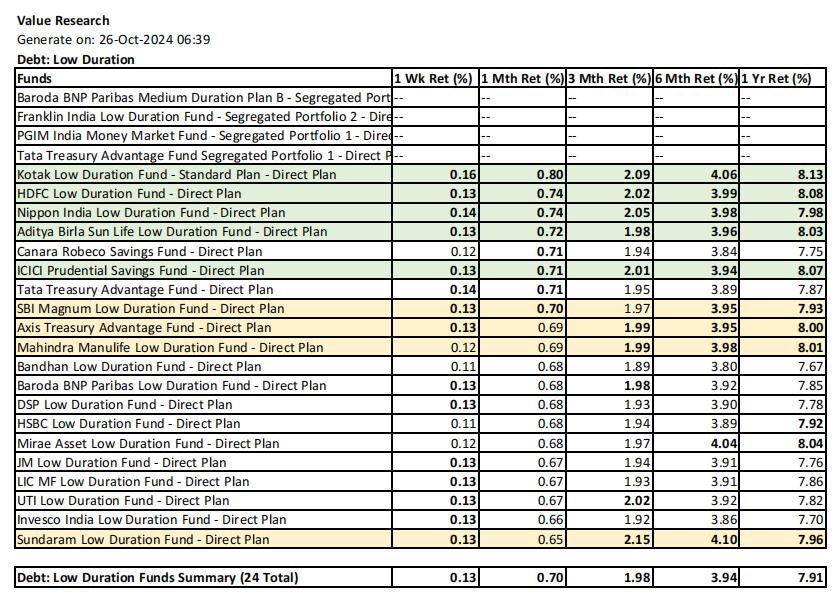

5.11. Debt: Low Duration Funds Summary (24 Total)

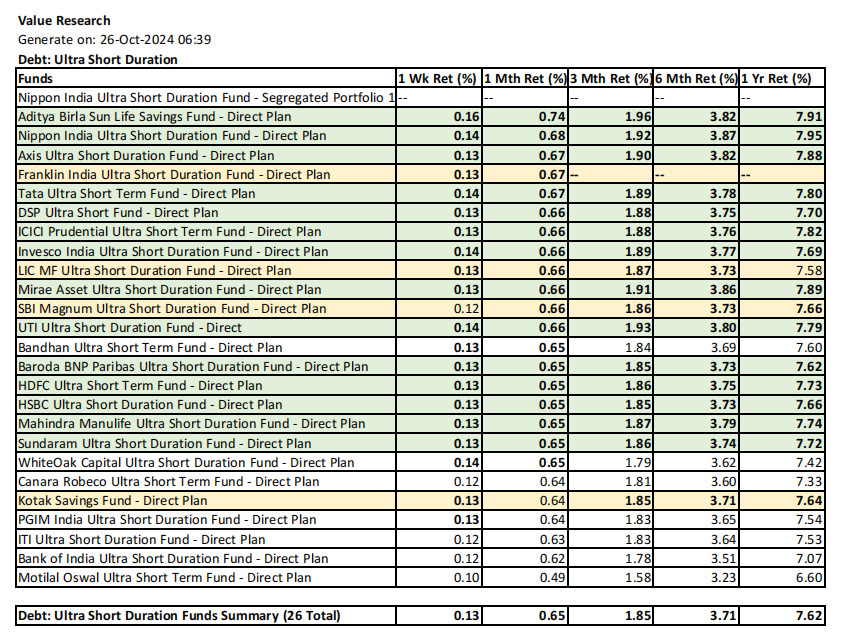

5.12. Debt: Ultra Short Duration Funds Summary (26 Total)

5.13. Debt: Banking & PSU Funds Summary (12 Total)

5.14. Debt: Fixed Maturity Funds Summary (91 Total)

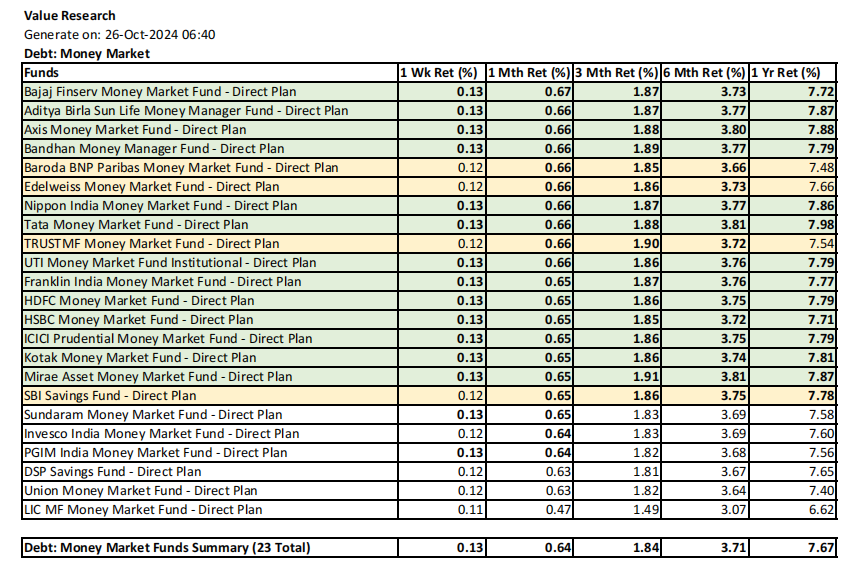

5.15. Debt: Money Market Funds Summary (23 Total)

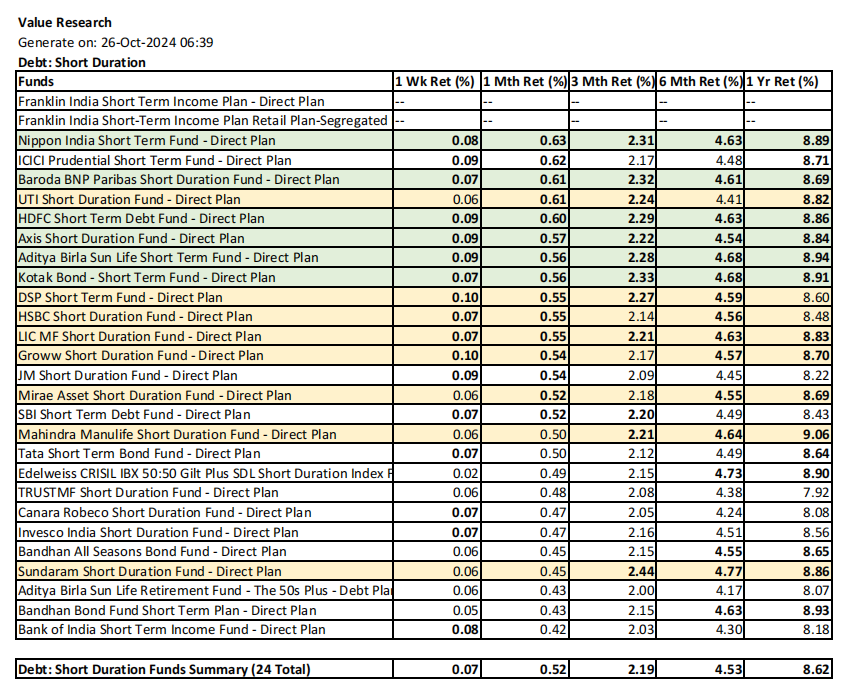

5.16. Debt: Short Duration Funds Summary (24 Total)

5.17. Debt: Liquid Funds Summary (48 Total)

5.18. Debt: Overnight Bond Funds Summary (36 Total)

5.19. Debt: Others Funds Summary (9 Total)

6. Whether it is a weekly Top 50 MF report or special MF report, these are availble in the blog indicated below. Blogs are also rendered as videos (on Youtube and Instagram) for those not prefering to read.

Blog: NatsFunCorner! on Blogger

https://natsfuncorner.blogspot.com/

Other relevant Social Network Platform links:

Whatsapp Group: This whatsapp group is a peer group, people active in investment and trading (including day trading) are here, exchanging their insight and views. Please note that there is no room for promotional participation here.

https://chat.whatsapp.com/IuzkVAHgn1jJ20ZmB8m9Vz

FB: https://www.facebook.com/nupadhya/

YouTube: https://www.youtube.com/user/nupadhya

Instagram: https://www.instagram.com/natsupadhya/

Twitter (X): https://twitter.com/nupadhya

LinkedIn: https: https://www.linkedin.com/in/nupadhya/

Disclaimer:

- This is not a solicitation for mutual fund investment nor an advice. It is only an insight to help investment decisions based on the free MF performance data downloaded from Value Research. Investment decisions are only yours to make.

- Mutual fund investments are subjected to market risk. Read the propsectus of a mutual fund for all the risk information associated prior to investment.

- The author can not be responsible for the ommissions or errors in the data from Value Research or the data processing errors if any by the author.

- All your investment decisions need to be based on your decision finally, with no blame to anyone else later.

No comments:

Post a Comment