1. The equity markets went through a significant correction this week, primarily due to China Investment stimulus, which caused the FII funds to flow out, and some domestic MF based on Hang Seng index sucking good amount of funds from the Indian equity market. The Middle East war situation and the F&O rules changes by SEBI also added to the negative sentiment.

2. As a result, we can see significant cut down in the overall equity returns (last line above) across 917 equity funds this week when compared to the last week. The Weekly Top 50 weekly return shrunk compared to the last week. While the Monthly Top 50 monthly return looks good, it is primarily due to Hang Seng index based funds. The Annual Top 50 annual return shrunk to 67.85 from 72.17.

4. The rule for marking a fund green is that it should have above average returns for all timelines from 1W thru 1Y. The rule for making a fund amber is that it should have above average return for all timelines from 1W thru 1Y except for one timeline, and if any of the 1W and 1M timelines have above average return, then it applies as above average for both the 1W and 1M timelines. Similarly, if both the 1W and 1M timelines have below average return, it is treated together as only one timeline having below average return for the Amber rule.

5. ICICI Prudential Nifty Metal ETF still looks attractive for investment though it slowed down to below average return this week.

7. Looking at the Annual Top 50 equity list, Bandhan Small Cap Fund makes it back to green, indicating that it is tough and can hold on against adverse short term situation like this week.

8. Looking at both the Equity Weekly Bottom 50 and Equity Monthly Bottom 50, one can gauge the bearish reversal. Bearish reversal for the fund is marked in red, for having either weekly or monthly return below average in the list, but the annual return above average in the list. The candidates for bearish reversal belong to Realty, Auto, Tourism, Infrastructure, PSU, Nifty 200 Alpha 30, Momentum, Value, Quantamental, Defence, Oil & Gas etc.

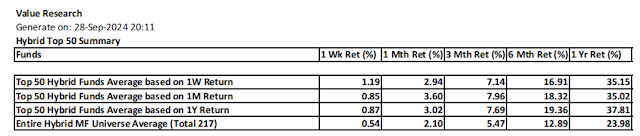

10. Looking at the Hubrid funds return summary across this week and last week, there is an impact of equity correction. While Weekly Top 50 retraced, the Monthly Top 50 improved simply because the traditional Monthly Top 50 leaders made back to the list.

11. Looking at the Hybrid Weekly Top 50, we can see too many conservative hybrid funds have come into the list, thanks to the equity correction thru the week.

12. For some reason, debt funds had subdued and even some negative return for the week.

13. The commodity funds further appreciated thru this week, though at lower pace. The annual return average now looks very impressive, close to Hybrid fund averages.

14. There is churn out in commodity funds leadership this week.

15. Whether it is a weekly Top 50 MF report or special MF report, these are availble in the blog indicated below. Blogs are also rendered as videos for those not prefering to read.

Blog: NatsFunCorner! on Blogger

https://natsfuncorner.blogspot.com/

Other relevant Social Network Platform links:

Whatsapp Group: This whatsapp group is a peer group, people active in investment and trading (including day trading) are here, exchanging their insight and views. Please note that there is no room for promotional participation here.

https://chat.whatsapp.com/IuzkVAHgn1jJ20ZmB8m9Vz

FB: https://www.facebook.com/nupadhya/

YouTube: https://www.youtube.com/user/nupadhya

Instagram: https://www.instagram.com/natsupadhya/

Twitter (X): https://twitter.com/nupadhya

LinkedIn: https: https://www.linkedin.com/in/nupadhya/

Disclaimer:

- This is not a solicitation for mutual fund investment nor an advice. It is only an insight to help investment decisions based on the free MF performance data downloaded from Value Research. Investment decisions are only yours to make.

- Mutual fund investments are subjected to market risk. Read the propsectus of a mutual fund for all the risk information associated prior to investment.

- The author can not be responsible for the ommissions or errors in the data from Value Research or the data processing errors if any by the author.

- All your investment decisions need to be based on your decision finally, with no blame to anyone else later.

No comments:

Post a Comment