Commentary:

1. The equities corrected further thru this week. The chances of equity falling to the Nifty level 0f 22,000 which is pre-Lokasabha results situation in June 2024 is quite possible. The equity mutual funds too reflect this severe correction thru this week.

2. Looking at the Weekly Top 50, the ones in the green or amber are those pertaining to equity outside India. The funds are marked in Green for having above average return within the list for all timelines from 1W thru 1Y. The funds are marked in Amber for having above average return within the list for all timelines from 1W thru 1Y except for one timeline, and here the 1W and 1M timelines are considered as one timeline together, so if the return is above average in any one timeline among these two, then both timelines are considered as above average.3. Even in the Equity Monthly Top 50, we can not find any fund in Green or Amber.

4. In the Annual Top 50, though there are some funds in Green, they have negative return for the week and the month, though these returns are above average within the list.

6. The monthly bottom 50 fund list is used for potential bearish reversal sign, similar to the weekly bottom 50 list.

7. Annual Bottom 50 list is used for potential bullish reversal sign, which is when both the weekly and monthly return are above average in the list. Such funds are marked in Grey.

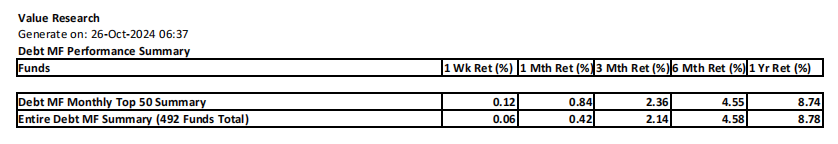

10. Debt funds too had sub par short term return through this week. But debt funds short term returns are better than that of equity and hybrid funds on average.11. Debt funds Monthly Top 50 is similar to what we saw last week.

12. Commodity funds had a good week though it is not as good as last week. Overall commodity funds annual return is approaching 30% which is quite envious for those not invested in them.

13. Thanks to two weeks of bull run, there are many commodity funds in green. Commodity funds beg for short term investment given negative sentiment on equities ahead further.

14. Whether it is a weekly Top 50 MF report or special MF report, these are availble in the blog indicated below. Blogs are also rendered as videos (on Youtube and Instagram) for those not prefering to read.

Blog: NatsFunCorner! on Blogger

https://natsfuncorner.blogspot.com/

Other relevant Social Network Platform links:

Whatsapp Group: This whatsapp group is a peer group, people active in investment and trading (including day trading) are here, exchanging their insight and views. Please note that there is no room for promotional participation here.

https://chat.whatsapp.com/IuzkVAHgn1jJ20ZmB8m9Vz

FB: https://www.facebook.com/nupadhya/

YouTube: https://www.youtube.com/user/nupadhya

Instagram: https://www.instagram.com/natsupadhya/

Twitter (X): https://twitter.com/nupadhya

LinkedIn: https: https://www.linkedin.com/in/nupadhya/

Disclaimer:

- This is not a solicitation for mutual fund investment nor an advice. It is only an insight to help investment decisions based on the free MF performance data downloaded from Value Research. Investment decisions are only yours to make.

- Mutual fund investments are subjected to market risk. Read the propsectus of a mutual fund for all the risk information associated prior to investment.

- The author can not be responsible for the ommissions or errors in the data from Value Research or the data processing errors if any by the author.

- All your investment decisions need to be based on your decision finally, with no blame to anyone else later.

No comments:

Post a Comment