This presentation is stored here in this blog, so that it can be accessed universally by all, beyond my network!

Wednesday, January 3, 2024

India Mutual Funds Review for Year 2024 and Beyond!

This blog will store my Mutual Funds analysis snapshots.

This activity started on Dec 26, 2023 to support my own mutual funds investment through year 2024 and beyond. While I have moved my level of investment expertise from a Dummy to Intermediate level, it is my desire to grow as a mentor to the Dummies as I strive to reach the next level of expertise called "Dog".

As one becomes expert in investments, there is a desire and ability to beat Mutual Funds return. But, one needs to be disciplined like any professional money manager for the same. Therefore, this analysis is useful not only for the dummies and intermediaries, but also to the dogs and dog wannabes.

This analysis will get more sophisticated as I evolve ahead. Idea is to store all the snapshots of the analysis, so that bothe the analysis evolution and market transformation can be captured.

As new snapshots arrive, they will be added to the blog, by pushing the old snapshots down. This intro will remain at the top.

Feb 10, 2024:

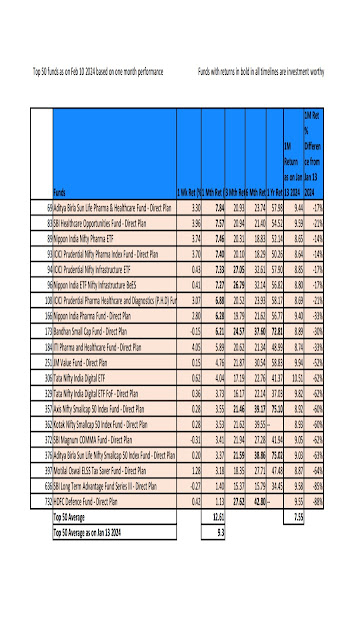

Top funds based on one month return as on Feb 9 2024:

1. From this week, the comparison window is for four weeks i.e. 28 days. The baseline date is therefore Jan 13, 2024 like last week analysis, except the time window is moved from 21 to 28 days.

2. The IT stocks recovered and bank stocks declined thru this week, hence we can see the impact on top funds rankings.

3. Though indices corrected through the week, the top 50 funds one month return average raised to 12.61% when compared to 10.49% thru last week. This gives further assurance that top 50 funds tend to do bette than other funds when indices are corrected downwards. Of course, there will be churnout in top 50 funds on weekly basis, hence new investments chasing top 50 funds per recent performance and also consistnecy of performance across other timelines (3M/6M/1Y) is likely to give better returns ahead.

4. Superior fund performances for 1M and above are highlighted with Bold. Please consider superior perfomances not only in 1M timeline, but all other higher timelines, for the investment decisions.

5. 21 funds have been knocked of from top 50, when compared to last 28 days window.

Feb 3, 2024:

Commentary:

1. Top 50 funds based on superior one month return are tabulated. Their performance across 3M/6M/12M give clarity as to consistency of performance.

2. After the top 50 funds, the funds which were in top 50 as on Jan 13, 2024, i.e. three weeks back are also listed. This gives an indication of churn out on top 50 funds. From next week, it will be comparison with top 50 against 28 days.

3. This list is useful for fresh buy decisions. One can consider the superior performance across all time lines for consistency of performance, superior performer returns are in bold.

4. Also, among the ones exiting top 50, two funds still have superior one year return and one fund has superior 6M return.

5. This analysis gives me further confidence that one can aim 40-45% annual return on new investment on top consistently performing funds, assuming market remains bullish like this.

6. Comparison of funds performance in your own investment portfolio will help you to identify the average and below average performers, and therefore will help you to come to Hold and Sell decisions as needed.

7. I do challenge all the mutual fund investors to aim at least 30% annual return, and likely a 45% superior return, by being vigilent on performance, for the current market conditions, which have not changed from bull market.

8. Among the top 50, I do say that, those funds with superior return on all time frames 1M/3M/6M/12M can be treated as darlings, and can be monitored beyond, for further investments in future. Obviously, I am ignoring the performance beyond 1 year for this analysis.

9. Also, it is possible that some darlings may fall of top 50 temporarily, so patience to hold them for at least three months after the fall from grace for sell decisions if not hold decisions.

10. This year we first saw the wave of IT funds, then the pharma, PSU & infrastructure funds, now the PSU Bank funds too. IT funds have lost shine, pharma too a bit. Curious as to what will come next. Certain index funds are consistent winners.

Jan 27, 2024:

MF one month return analysis as on Jan 27, 2024:

1. A new measure is pursued, which is the average one month return of top 50. Last week, it was 6.24, where as it is 7.35. The weekly return of Nifty 500 through last week was -1.11%, where as this top 50 funds overall performance differential was (7.35-6.24)/6.24 = 17.78%. This should not be a surprise, as the top performing funds should do better than the broader market performance. It is difficult to say whether this happens always (see the next point). In support of this data, another observation is that only 10 MFs fell from top 50 this week, where as lot more fell off thru previous analysis.

2. Only 2 among top 50 have shown more than 10% deviation on weekly negative returns (Red color). 17 (yellow) have remained in -10% to +10% range on weekly returns. Whopping 31 funds (green) gave more than +10% return while broader market corrected slightly.

3. The above two points reconfirm return on investment for this analysis further. It is good to note that average annual return based on last one month return for these top 50 is around 85% even after two weeks of broader market dip. It is hoped that as an individual mutual fund investor, one learns to achieve at least half of these returns on portfolio level, though that can not be promised yet.

4. Also, an open issue for an individual is that, if a major correction is around the corner, should one churn out low performing funds to move the money towards better funds, at the risk of 15% short term gain tax payment. The opportunities of better returns plus impending losses on potential correction need to outweigh this 15% short term gain barrier. I personally will look at my portfolio thru next weekend, for exit after budget news. I will look for at least 1:2 risk reward for such a move, meaning, I should gain 30% more on the funds released for the rest of the year (14 months actually as new investments need to be held thru next financial year) ahead. And, if I make this move, I will give at least one month window to wait for fresh investments as the timing of major correction nadir, if out there can not be perfectly timed.

5. Attempting the similar observation for the previous week, the broader market based on Nifty 500 corrected by 1.39%, the average change in top 50 was (6.24-6.8)/6.8 = -8.3%. What this means is that when the broader market direction changes, top 50 mutual funds performance is more highlighted initially (meaning correct more, or enhance more when compared to broader market), but then the top 50 funds catch up with the new trend and remain superlative in performance when compared to the broader market. Again, it is pending as to we can confirm this for all iterations of correction begin.

6. Hence, when we anticipate a correction, it may or may not make sense to hold up against fresh investments, if the fresh investments are targeted to the latest top 50 performing funds. Since the broader correction tends to happen over multiple weeks, and one can not anticipate the amount of correction, it is hard to guess the impact on recent investments. The corollary, which is when the broader market takes off, its impact also is spread across multiple weeks, and mutual funds will typically do well irrespective of benchmark against broader market moves. A more firm trend for correction can be analysed when we complete at least a one month differential of top 50 funds performance over a major correction, which may or may not happen to be available by Feb end.

7. Therefore, it is fair to say, that it is ok to continue to make fresh new investments into top performing mutual funds when the correction is mild (which is the case so far). But, my intuition says that it may be worthwhile to withold new investments if the correction anticipated is bit severe. I intuitively anticipate severe correction through February, and I could be totally wrong, but I have decided to hold off on new Mutual fund investments since Jan 13th .in spite of weekly detailed analysis.

8. With this week’s data, now we have three weekly data extract of one month returns. From next week, the analysis will shift to 28 days performance difference for the top 50. This way, we will get a clear picture of which funds are falling off from the top 50 on a monthly basis almost. Also, it is possible to highlight which funds came into top 50 on a monthly basis almost.

9. Like to make an observation on house affliation of top performing funds:

This week ending Jan 27, 2024: Quant - 14, ICICI Prudential - 7, Motilal - 4, Nippon-4, ABSL - 3, Bandhan - 2, Mirae-2, Mahindra-2, Invesco-2, Tata -1, Taurus -1, Samco-1, ITI/JM/Kotak/Edleweiss/Axis /SBI/UTI- 1 each, Other (CPSE ETF) - 1.

Similar observation for the week previous ending on Jan 21, 2024:

Quant - 13, Motilal -7, ICICI Prudential - 5, ABSL-3, Bandhan-3, Nippon-3, Mahindra-2, Axis/Edleweiss/HDFC/ITI/JM/Kotak/LIC/Mirae/SBI/Tata/Taurus/UTI-1, Other (CPSE ETF)-1

No wonder, one of my friends’ response to my analysis was that, just load your new investments to all top Quant funds and forget about it. Ha..Ha..

10. For some reason, Value Research includes CPSE ETF alone in the mutual funds list, while the investment to the same needs to be done like an ETF stock with the broker, hence there was some delay in my investment to it due to confusions. While I have witheld new investments to top funds here since Jan 13th, I could not help investing into this ETF finally (too little, too late, as its one year return as on this week is 84% and still ranking first), and hope to hold and gain thru budget week in early Feb. Wonder, whether this too will correct significantly post budget news, as when the correction mind sets, biggies like to shave off on the top performers too, only to re-enter quickly at lower levels.

11. Hope to find better grounding on more impacting inputs to monthly fresh MF investments next week, as the analysis will move to 28 days window than 1 week window. We needed these three weekly snapshots so far to get ready for it. So, pls. Look forward to next weekend analysis.

Your further analysis, insights, recommendations pls.

Jan 21, 2024:

Top 50 funds with best one month return are picked up and then compared with the similar list last week.

1. The funds falling from top 50 are shown in red, after the first fifty lines. Most of them belong to IT funds, though other types too are there.

2. Very few funds have done better than last week, most of which are new entries to the top 50.

3. This analysis is more useful to do, after major market event like this week, where corrections came around IT stocks and HDFC Bank.

4. Plan is to store weekly snapshots, and make last one month performance comparison, when the situation warrants.

5. Some of the funds survived in the top 50 due to better performance before, we can anticipate significant churn out in the top 50 whenever major market event occurs.

6. It is safe to say, that among top 50 funds based on one month return, those who have equally better performance over last one year, their superior peformance trend continues.

7. Please note that this top 50 is not a recommendation to invest, rather an aid to understand the churnouts in performance of top funds.

Jan 13, 2024:

Since all my previews analysis were based on Money Control website, which omits many important fund data, it is fair to say, that please ignore all my earlier analyses. This analysis is based on Value Research which is far more reliable.

Jan 07, 2024:

Dec 27, 2023

Edit of Baseline snapshot on Dec 27, after adding three JM funds per certain reader feedback:

Dec 26, 2023

Baseline Snapshot as on Dec 26, 2023: Limited to Equity Funds only given the bullish nature of the market for now

Monday, January 1, 2024

2024 New Year Eve Camp Fire at Gopalan Olympia: My inspirations!

2024 New Year Eve Camp Fire at Gopalan Olympia: My inspirations!

Note: Though I wrote this as a note for circulation within our community at Gopalan Olympia, I do see relevance for all types of communities to consider upon my inspirations. Hence, turned it into a blog.

Context:

I did get to participate in the New Year Eve Camp Fire, that was quickly organized and executed. I had good fun. Thanks to all the organizers, volunteers and participants. This write up attempts to leverage the spirit that soured, and resulting inspiring thoughts!

This may be a long write up, but to read it fast and furious, I have numbered the topics with headings and bottom line summary!

1. The one percent rule!

It takes less than one percent effort and energy to get something good or bad started!

What is that one percent gift I have for the rest? How Good it can be? Who can it help me to get it going?

As a humanity, we are complex animals. But, if we observe our endeavors, whether it is at the level of self or collective, it needs a solid take off in the beginning like a rocket attempting to beat the escape velocity against earth. Once, it is done, it is all smooth sailing. So, this take off needs two things: The power of Sankalpa, and some minimal organization discipline to ensure escape velocity around it. The rest is taken care by the participating rest.

So, let us not be shy in searching our soul as to those genuine inspirations inside us, and act on them through a statement of Sankalpa. Then, actually we can sit back and wonder, how this Sankalpa makes us stand up and runs us around to get that initial trigger going. Then, we can also see, how help comes our way for the escape velocity to build, and our inspirations are put in action! At the end, there is a contentment of accomplishment and the difference made, thanks to all thouse pour in to pariticpate and make it happen!

To build a great community we deserve, let us keep our senses up to spot those one percent energy and angels around, and sport with them on a regular basis.

2. Why we deserve the excitement of new year!

Because it is a timely reminder to leverage our time and space to optimize self and our journey ahead!

Our journey on this heaven called earth (which can also turn to be a hell) is finite. We have limited time, and we are all way too busy. So, we do need escapade from our grind, more often than we get. This new year eve is an ideal excuse for us to take this break from oursevles, and seek that fresh outlook, attempt, and approach. That in itself is quite exciting, while it lasts. But with some discipline, we can make sure, that this excitement lasts through the entire year.

3. It is all about the Fellowship!

Huge benefit of living in a large community like this is the leverage of fellowship we can exploit!

We are social animals. We always love the company,touch, interactions and exchanges. While our apartment may bring some isolation we deserve and desire, our apartment community can complement this with the vibrant social set up we deserve.

Therefore, we need to pursue highest levels of ethos of civilization. We learn to love and respect. We learn to coexist with diversity. We learn to live and let live. We learn to become better communicators and leaders. When misunderstandings and misgivings surface, we learn to deal with them with a sense of faith and positivism, only to rebound better towards higher potential and planes.

4. The paradise Code!

It takes two paradises to co-exist! One inside me and one around me. I can leverage both to create a positive spiral for self and the rest!

Paradise is an ideal place to dwell in. We all deserve the paradise. It is actually in our reach. We need to strive for this paradise both inside us, and around us.

Paradise does not mean that everything needs to be perfect. But, there needs to be a commitment towards that evasive perfectness (faith), and a level of surrender (lightness) to live our best around the imperfections that bother.

When it comes to the paradise inside us, we need to have a decent grip on who we are. We are a complex being, but we can simplify our own understanding (self realization), by onion peeling us, as Body, Mind, Heart (Feelings, Wisdom or Viveka), and Spirit. We, then can evaluate our presence in all these four layers, and seek improvements in these layers simultaneously. This accelerates our journey towards creating the paradise inside.

Our outside too can be a paradise. We need some simple rules to follow. Do no harm willingly. For example, do not throw trash around, just because it is convenient. Another rule, is that charity begins at home. While walking, if I find a trash, I can pick it and throw it into the nearest dustbin. Given our diversity, we can agree to disagree, but always enhance our formal or informal constitution, which is the set of agreements we formulate and follow. We keep tinkering with this constitution, as we evolve and mature, both at the level of self and community.

The one percent rule helps us to expand the paradise both inside and outside, not just for self, but also for all concerned. Fellowship makes it easy to build the paradise or the interior/exterior design leading to the aura of paradise.

5. Synergy across age groups!

Though we are one community, we do have distinct age groups with different priorities and preferences! Yet, how can we synnergise across better?

I distinctly see the following age groups in our community:

Infants: They are the fresh arrival to our paradise. The parents who toil around them are the angels. How can we make the life of infants and their angels better? How do we manage noise and air pollution better for them. What helping hand we can give to them?

Kids: Kids are the soul of our community. They are the promise of our future. Their energy and potential is always inspiring for all concerned. How do we keep them motivated, playing and disciplined. How do we help them as a community for them to shape the great future they deserve?

Young adults: These are the folks making difficult transition from dependent kids to the independent adults. How do we honor their natural rebellion. How do we create better space for them to interact among themselves and seek the solace and hope they deserve. How can we help them with the stress of competition they have to deal with, on a daily basis.

Renting students around us are mostly young adults. We can help them to have better time here. It is all about security, enthusiasm, energy, discipline, focus, and fun they deserve. I hope, that we evovle to a level, we will have an annual welcome party for the new student renters who arrive, and a send off party to those who graduate and disappear in search of better future. Need to think thru this further to make it happen.

Adults: These are the ones working, building their career, playing, falling in love, putting the family together, becoming parents, building their security and wealth. They are the natural leaders for their families. How can we give more space for them to lead our community in various endeavors. How can we enhance the fun breaks they deserve around their busy engagements.

Middle agers: These are the folks who are in their forties and fifties. They are tasting the success of their profession or business. They have built solid character in their life by now and have lot of lessons to share. They can lead and mentor. They can help with their networking and resources. How do we tap their potential for the benefit of the community?

Elders: These are the retired folks, who are gifted with the new and the last youth. They are successful, they have completed their responsibility to their kids. They have reasonable resources to relax and enjoy the rest of life ahead. They are wise, they can advise and mentor. They can be the cheer leaders and volunteers.

Very Elders: These are the folks who may have disability or ill health. The very elderly people going through health issues are to be supported. How can cheer them up. How can we make things easier to socialize. How can we help to take the sense of lonliness or dispair, if that persists. How can we make their ordinary days better, with the rays of extra ordinary.

Similarly, we need to ensure better access to those with special needs, where applicable.

Some avenues to take these inspirations forward:

A. Social network groups targeting specific age groups and interests

B. Specific events targeting the age groups left behind

C. Diversity of considerations for all age groups in our event planning and associated formal and informal leadership teams

D. I am a Rotarian, primarily to exploit fellowship and leverage the formal avenues of institutional charity. I am convinced that this community will benefit by having our own Rotary club here, which needs approximately 50 rotarians to emerge from this community. These Rotarians can dedicate all their energy for the priorities of this community, and wonders can keep happening

E. You can add further to this list….

6. The Six Elements to leverage!

Wood (Nature in general), Fire, Earth, Water, Metal and of course the Air!

We are from nature, so how we can enhance the nature around us, to bring more natural behavior within and across us. Also, considerations of aesthetics, balancing these elements in our home and campus is key.

Wood: This is all about green, flora and fauna. How can we build easily maintainable sustainable gardens. How can we enhance sustainability in our dealings.

Fire: How can we find more excuses for the camp fires. How do we ensure reusable wood for sustainable camp fires. How can we bring more fire element beyond camp fires.

Earth: How to do we minimize concrete finish, and enhance earth presence with greens and grass. How can we create natural walking paths. How can we maintain our grass surface better. Of course, how do we get our kids to play more in the sand…..Even glass is a form of sand, how can we leverage glass better.

Metail: What is the most judicious use of metals in our home and campus. How we can increase the synnergy of metal with other elements.

Air: How do we ensure that we breathe the best air possible. How do we tackle all the pollution around. How do we leverage other elements to purify our air better. (eg. Gardens, agnihotra thru fire, water bodies with purifying plants)

My inspiration is that we eventually build an artificial lake (using water retaining sheets) behind the current Marketing office where cement mixing is going on. We can get permission to use the public land by the Naala. This lake, though artificial, is a natural pond. The discharge water we now release to the Naala can be collected in the pond. Natural ways of cleaning happens through flora and fauna in the pond. The space around the pond becomes a wood with pathways of walking and resting. This sounds challenging, but doable. This spot becomes the sanctum sanctorum of our community with camp fire spots, hiking and tenting spots, outdoor event spots etc.

7. What it takes to build a vibrant community we all deserve!

We are all too busy with our own life, but we can do one small bit we would like to do, which can do wonders based on the first point, 1% effort, 100% leverage. The leverage comes from leadership, communication channels and participation.

Some bottom line considerations:

l Minimal segregation and groupism, better unity among diversity, more communication avenues.

l Better leadership development acorss the community across all age groups

l Formal and informal constitution that inspires us to come together towards the paradise we deserve, and allows us to negotiate better across all aspects needing alignments.

l More avenues to interact, synergise, celebrate and to benefit from social therapy we need time to time.

l Manage the dynamism. People come and go. New people deserve better orientation. People living deserve better send off.

l A community with 1300 homes is actually a mini city. So, let us embrace the complexity, yet keep things simple. Let us leverage our strengths and work on our challenges. Let us learn to manage ourselves better. Let us seek help among ourselves and beyond. .

You can add more to this hubmle list.

Best Regards,

Nataraja Upadhya