Image couresy:https://money.howstuffworks.com/personal-finance/online-banking/online-trading.htm

Prelude:

This is personal notes towards evolving an effective philosophy of trading for self, but a reader can benefit from this, while the caveats in this philosophy can hurt him or her too. Once the philosophy is addressed comprehensively, I will develop the NU Trading Commandments or Rules for the same, which too will be published as being evolved.

This philosophy is being evolved through a series of meditations and jotting down of inspired insights as a random collection of points to note. Hence, there can be gaps and overlaps in the resulting notes.

When we take up a journey of learning and transformation, our state of being becomes varied from point to point in journey. It can go through various stages like beginner luck, innocence of virgin mind, opening to risks of unknown, perils of half knowledge, excitement of monkey using a hammer for everything as it has got only one tool to use and is so excited about using the tool resulting in overusage, a level of saturation and apathy etc. Therefore, these notes may be refined by revisiting.

Therefore, any reader is advised not to stick to this philosophy per se, rather take inspirations and insights to develop a personal philosophy for the same.

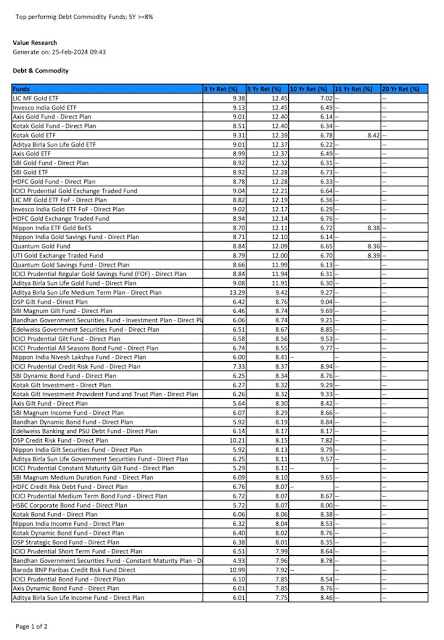

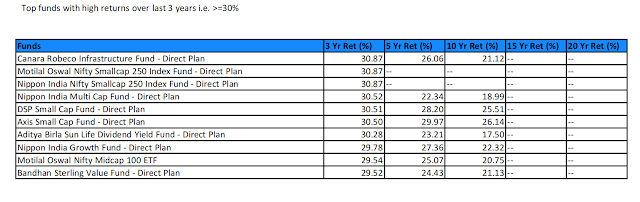

I personally have prioritized the journey of mastering intraday and swing trading at the cost of ignoring positional trading. This is because I see lot of synnergy between intraday and swing trading, and the dynamics associated are already full time engagement for me. For me, loss of not doing positional trading is being compensated by a series of swing trading and / or intraday trading. However, as a risk management measure, I invest in mutual funds in leu of positional trading for now. I will eventually get into positional trading, once I am convinced of achieving higher returns than this trading. Even then, I will keep the philosophy of positional trading separate from this philosophy, at least until I can integrate the philosophies associated into a wholesome one.

The salient features of this evolving philosophy is discussed a series of points of insights, combining packets of knowledge, observation, analysis and synthesis.

Once I complete this journey, which is documentation of comprehensive philosophy followed by time tested set of trading principles or manifesto, I will be ready to train others or coach. Then, these notes become very handy like a lecture notes of a new lecturer is used over next two three decades till retirement.

Evolving NU Intraday and Swing Trading:

1. Trading is like a fishing engagement. It needs a calm mind and soaring of the heart. It needs to be meditative while it can be exciting or sad one too. It is also like a solo dance or a martial art session. It needs some amount of preparation before taking the stage, and it needs some unwinding to do, after the session. There needs to be synnergy and harmony with the rest of life style too, as this activity is one small segment of life and living.

2. There needs to be clarity of purpose, objectives, strategy, plan and execution management followed by regular reviews towards mastery of the craft towards optimization of objectives. This aspect needs to be harmonized with the same at the life and living level too.

2. The purpose can be the amassing optimal amount of wealth over time, with optimization of efforts, fun, pain, and associated other sacrifices or adjustments.

3. The objectives under the clarity of purpose can be as follows: I am noting it directly in terms of success benchmarks.

- Return on engagement in terms of

- Money made

- Fun had

- Minimization of Exertion, effort, attention, homework, health loss etc.

- Sacrifices or adjustments of living made

- Minimization of risk, losses including notional, opportunity losses, inactivity losses etc.

- Optimization of theory, practice, dancing across dynamics into an artful expression that elevates through repetitive engagements

4. To optimize the objectives, the following metrics need to be understood, measured, and constant care needs to be there towards improvement and mastery:

- Optimal demand on margin investments

- Optimal return over time on margin investments

- Optimal write offs on bad trades, both in terms of percentage of write off per time, and frequency of write offs

- Percentage of being right vs. wrong, in terms of trade entry, trade exit. It is not just about being right from the perspective of returns, it is also about timing of entry, and quality of the trade script among choices available. There may need to be sacrifices made, one may exit a current profitable or loss trade to increase the returns over time for a better opportunity that surfaces. Since, trading context can be very dynamic like surfing, portfolio management discipline and principles do matter, will be discussed separately.

- Optimal balance between risk and reward, which again is dynamic. One can not plan for Black Swan events of the market, but there needs to be a level of dynamism to spot them as they appear. One can not be too greedy due to increase of risks and one can not be too fearful leading to loss of optimal opportunities.

- The core character of intraday and swing trading is leverage of momentum, momentum of the market and scripts associated. In surfing terms, the overall condition of the ocean is like market conditions, individual waves to ride on are the scripts. Then there is a question of how to get on to these waves, when to get on, when to get out, and how to harmonize getting off into a getting into a new big fun wave.

- Therefore, minimization of idle magins for risk and reward optimization also is a consideration.

- On a good market day, one can be like a drunken monkey, go around hitting everything with a simple tool like hammer and still be successful. On a bad market day, one needs to be far more meditative and be happy with smaller fishes caught in singular counts. So, the engagement approach too is very dynamic, one can not approach with a rigid rule. Market conditions can change within a day, in terms of 15 minutes window. So, the approach needs to be dynamic from a drunken monkey to a meditating saint.

5. Who I am shapes what I choose to do, and what I do shape who I am. Therefore, people signing up for trading expedition need to be fluid in living. So, I am now approaching the psychology aspects, transformation aspects and price to pay through trading engagements.

- Trading is not for all. First of all, there needs to be a level of acceptance and self esteem in trading. This is possible only if the philosophy of one's life is aligned with the realities of trading.

- Trading is not for proud people, proud of being, proud of doing, proud of achieving, and proud of making a difference. They have much better opportunities for the same.

-Trading is not for fearful people. This is too much unnecessary trauma to go through for such people.

- Trading is also not for greedy people. They can do better robbing a bank elsewhere.

- Trading is well suited for people like me, philosophical, lazy, observant, analytical, amoral (above right and wrong than being insensitive to it), able to experience zen among chaos and multi level dynamics, enjoying a complex dance where there are no rules but you are willing to make your own rules and can enjoy solo dance with no partner, one who can enjoy the solitude, can balance the self expression across what is out there Vs. what one wants to unleash with and open to the results whichever they may turn out to be.

- Therefore, the funny thing about trading is that while the objectives could be optimization of returns including the money aspect, it is a journey of transcendence across uncertainities, half knowledge, risks, rewards, surprises, serendipity and some times pitiable dead market conditions. One who is comfortable to balance sanity with insanity will do better in trading.

- So, one may get into the journey of trading with a narrow objective or open drifting life style. But, once on this bandwagon, series of transformations will hit the individual with no mercy. Therefore, people dedicated to one particular vision or objective in life should avoid trading. Trading is the best avenue for the lost souls like me, who enjoy drifting, eternally happy in a student mode than being an achiever, an observant philosopher, or outright jobless and purposeless in life. Trading is a huge distraction for the one with other significant purpose in life. Trading could be a fruitful distraction like someone taking a fishing expedition through the weekend, but I am ignoring this aspect for now, as the transformaitonal price to pay could be much larger than the returns of temporary distraction desired. So, this trading expedition is like going into a dark rabbit hole, being ready to face whatever thing appears through the journey.

The corollary also is true, which is that trading can fit anyone aligned to it, and can afford to commit to it. Growing up, I liked listening to classical music, but was very clear that I will not dedicate myself to learn it. Only way I said I will dedicate to it, is that if I am imprisoned and have nothing else to do in life. Similarly, one who wonders what to do in life and has not many options possible, can consider trading as a profession, especially those who are stuck at home for various reasons. Since I am entering the retirement phase of life, my health may gradually wane, I made concious decison to keep rest of my life online and of mental engagement with no excuse of dependency on others for my retirement engagement. Trading fit me very well, I can do it till my eyes and mental acumen do not give up. Also, I had enough life experiences with a sense of completion, and trading fit me as one of the best avenues for optimal returns of time, energy and passion.

6. Once being a successful trader, one can have mutliple other overlapping life purposes and engagements, but trading needs to be at the center of it. Trading requires a full time alignment if not engagement to market hours, it may need some amount of preparatory home work and winding down routines, so it can be an intense ten hour engagement on a working day. So, it needs to be embraced as a profession and not a on and off hobby. The rest of the life needs to be realigned to this profession. Like a doctor who will refuse to do surgery on the road side, a trader needs to minimize engagement if a day requires presence elsewhere. But, a doctor is trained to do the needful when a crisis occurs in a remote location with no aids. Similarly a trader can engage in minimal trading away from the market, and this is a separate discussion later. The possibilities for a trader, in life out side trading, is also a relevant subject to discuss, but will be dealt at later stage.

7. Trading requires a stage set up like setting a stage for a dance recital. This of course includes optimal account features, use of lap top and a smart phone simultaneously, access to instantaneous fundamental and technical analysis, quick validations through trading rules for buy, hold and sell decisions, parallel background work for margin management, risk management, portfolio optimization etc. Since trading requires a series of cycles of opportunity hunting or alerts, evaluation of opportunities, entry and exits, management through opportunities, revisit of opportunities engaged before or dropped, set up of the laptop across these dynamics is important. Optimal utilization of resources across computer speed and memory, same of the remote servers for the same, hopping across screens etc. are part of the dance. A small delay in trading decision or execution can have an impact. (Certain trades need to be market mode for speed, some need to be on limit mode for better returns).

8. Whether one trades at home, or home office, or elsewhere, distractions are part of the game, some distractions are voluntary and some are involuntary. An execution discipline through the market hours does matter in this regard. Typically for an Indian Market, one can dedicate one to two hours of home work before market open, certain observations through the pre-market dynamics of 15 minutes before open, the excitement of market open dynamics that can last for 15-45 minutes, major market impacts at different time intervals, typical market lull during 11am /12 pm thru 2 pm, market excitement in the last one hour, and market players making certain bets for the next day, last 15 minutes of market death dynamics for the day etc. So, best time to take a long break is during 12 pm thru 2 pm. Even during this time frame, a particular opportunity may come and go. One needs to assess the value of time. For me, I may take a cooking break, but with something on the stove, I may steel five minutes away, make a profitable trade in that five minutes, and go back to cooking mode. This aspect is unique to intraday trading. Since momentum leverage is the game, one can get into and out of miniscule time trades, and such opportunities can be 10 such trades in an hour on a good market day, while nothing may happen on a dull market day. So, one needs to be dynamic on taking the breaks too. I may choose to be distracted with protracted lunch and a TV show during the lull hours on a dull market day, or skip cooking and eat some readily available food by the laptop minimizing only to toilet breaks on an excited market day.

This dynamics further complicates, if one chooses to play in multiple markets, not just the Indian market. One should not plan to work for more than 10 hours a day on such realities.

9. Upcoming

- How many trades for the day

- Trade size and life span

- Margin management

- Portfolio optimization

- Risk Reward management

- Health management of a trader

- Many more topics...