Commentary:

1. Debt funds are meant to give returns slightly higher than the Fixed Deposits. Debt funds can have higher risk than fixed deposits, and tend to give superior returns when the interest rates are falling. Debt funds return are primarily depending on interest of debt instruments, but the face value of a debt instrument can fall when interest rates are going up. Therefore, it is possible that a debt fund can also give a negative return through such periods.

2. Debt funds had a taxation advantage till March 2023, as indexation benefit was available. With that removed, the taxation benefits are gone, debt fund incomes are taxed at par with Fixed Deposits, as part of income.

3. For this analysis, both the debt funds and commodity funds are included, which are not included for the equity funds analysis.

4. Since, there is an expectation that prime interest rates are likely to fall from June 2024, there will be some interest in debt funds in coming months, to beat the returns of fixed deposits. So, some money may flow from fixed deposits to debt funds. Hence this analysis as a baseline before the debt fund attractiveness goes up in couple of months ahead.

5. For an equity investor, there is an opportunity to ride on debt instruments through hybrid funds. These hybrid funds can be aggressive on equity, conservative on equity, or can use balanced or of multi-asset approach. Hybrid funds are always included in my equity funds analysis. I would believe that only when the hybrid funds start beating the performance of pure equity funds, it is time for us to wake up to the reality of debt funds to leverage. When there is a correction in equity market causing negative return on mutual funds, the hybrid funds and debt funds will start looking attractive.

6. Therefore, with the tax savings advantage gone, one could say that debt funds can be considered to replace FDs when they become more attractive than FDs, and hybrid funds to replace pure equity mutual funds when the market starts correcting leading to negative returns on pure equity mutual funds.

7. There is inherent risk in debt instruments, and this risk is reflected through the credit rating of the instrument. But, this risk is managed overall at the mutual fund level. Therefore, it is always better to choose a debt mutual fund than a singular debt instrument like NCD etc. to manage the risk better.

8. Credit Risk Fund are a type of debt fund, where the focus is to invest on high risk debt instruments, leading to better returns as the interest rate associated are very high. Here, the strategy is to manage the high risk across the portfolio level, and ensure better returns than the usual debt funds. Typically, this works well when the economy and market are upwards, but when shit hits the fan, such funds can give massive negative returns. Since India market has been doing well since last three years, one particular credit risk fund has given more than 40% annualized return on a 3 year basis, which is amazing, but still pales against equity fund returns, given the level of risks are similar.

9. Personally, I have ensured my life style through FDs, and enjoying an average of 8% interest rate on them, hence I have ignored the debt funds so far, focusing purely on equity funds for MF investments. But, imagine that FD interest rates could be falling to 6% in future, and the debt funds giving superior 10% return, even I will be jumping into debt funds mode.

10. When it comes to the risk of pure equity funds risks, where the fund returns become negative on huge market corrections, my strategy is to shift to hybrid funds for fresh investments, as they will be popping on the top of the table in my weekly mutual funds analysis. I did this debt fund analysis for one time now, for me to get a grip of historic realities and a baseline benchamark before interest rates start falling in coming months.

11. Fair to say, that keep reading my weekly mutual fund analysis report, as it gives a good mirror to equity market dynamics, and your fresh investments are automatically adjusted to the new market realities, whether up or down.

12. Will consider a monthly debt & commodity funds analysis as they become attractive for fresh investments. If Gold invest becomes attractive, it will pop up in this monthly report as commodity funds to are included.

---------------------------

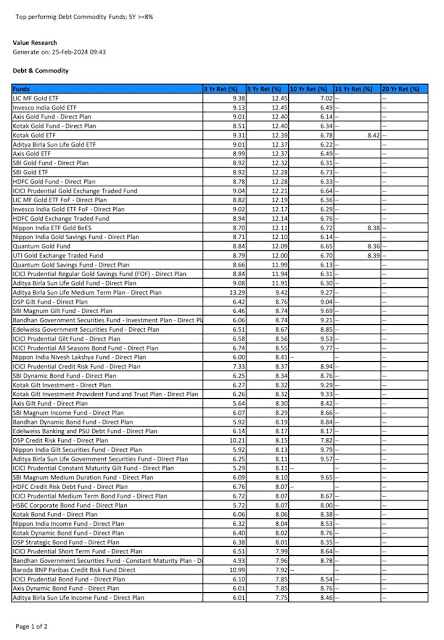

Top returns of Debt and Commodity Funds, both short term and long term

A. Short Term

Section1 - 1 Week Return

Section 6: 3Y Return

Section 9: 15Y and 20Y Return

No comments:

Post a Comment