Commentary:

This is an attempt to view top performing mutual funds based on different time lines. All the data is from Value Research, and only the equity and hybrid funds are considered here.

Value research gives mutual fund data in two perspectives, short term and long term. It does not give the perspectives with both the short terms and long terms together. For value research, short term is presented in terms of 1W, 1M, 3M, 6M and 1Y. Long term is represented in terms of 3Y, 5Y, 10Y, 15Y and 20Y.

Ideally, I could have merged all timelines into different columns in one sheet, but that required combining two sheets using VLOOKUP. Since I use free office software and it does not give me that function, I have done this presentation this way, for my convenience.

If you have patience to combine the short term and long term perspectives into one single sheet, you can download the data from Value Research from these links, while downloading you need to select all Equity Funds once, and all Hybrid funds next, so you need to combine two worksheets once in each of Short Term and Long Term category, and then you need to integrate the two resulting worksheets at column level using VLOOKUP function.

Data source:

Here, one needs to switch between Short Term and Long Term buttons given at the row where download to Excel option is given, and make separate excel down loads across two timelines.

The mutual fund returns have become far more attractive in India since the last three years. Therefore, we can see funds with 3Y return as high as 52.58%. As we move the time window farther, the return percentage reduces, for two reasons. One is that both the market and the funds were not evolved like now a days. Second is that mutual fund performances tend to saturate over time like the index returns. Typically, index based mutual funds tend to follow the index level returns with 1 to 2% overhead due to expense ratio. Also, we can see that as the time line is stretched far before, number of available mutual funds also dwindle. Also, here, we do not know the history of Indian mutual funds beyond Value Research boot strap, still we have 20 years performance data in this report.

Those who have been in the market for more than two decades are very much accustomed to 15-20% long term returns as healthy for mutual funds. Folks like me who are new to the fund investments, are very much spoiled by the recent top returns of mutual funds, and demand very high annual returns for the current market conditions. While the old tigers are conditioned not to aim for more than 15 - 20% annual returns, we the new bees are aiming for 60% annual returns while such previlege lasts at least.

Here, I have used the following cut off benchmarks for the top performing funds by timeline:

1W : >= 2.5% return

1M : >= 10% return

3M : >= 20% return

6M : >= 35% return

1Y : >= 60% return

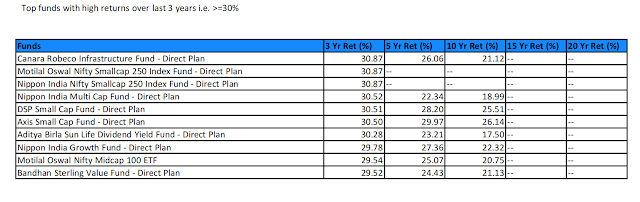

3Y : >= 30% return

5Y: >= 25% return

10Y: >= 20% return

15Y : No benchmark, very few in the list

20Y : No benchmark, very few in the list

Take a ride with different timelines, and give a bow to the top performers for each timeline. Also, note down the long standing high performers of yester years, and how the mutual fund market has expanded significantly through the last one decade. The competition for top rankings will only go up further from here.

To put things in further perspective, I have quickly calculated nifty returns for the similar timelines by fetching approximate nifty levels from the charts over different timelines as follows:

Based on these levels, I have calculated nifty returns, and compared with highest return from a top fund for the same timeline, and a typical MF return at portfolio level at half of top fund return. Take a look:

My analysis on this:

1. Top performing mutual fund is way ahead of nifty returns for short term, but it starts falling closer to nifty returns for longer timelines. I have ignored 15Y and 20Y timelines for mutual funds as the mutual fund market then was not mature.

2. What is an useful practical benchmark for our portfolio returns is in the last column, which is half of top performing fund return. This is some what close to the intuitive benchmarks I have used for marking top funds in the report below.

3. One insight going forward is that Indian stock market and therefore mutual fund market have been maturing considerably through last few years. Also, there is a good chance that the long term returns from India could be far better than they were 10 years before. Therefore, there is a need for the investors to adjust the self esteem and expectations higher into the future, and upgrade the expectations beyond the historic benchmarks, and set it somewhere in between what they were and whatever sizzling level resulted through the last three years.

4. Bottom line, through this analysis, I am further convinced that it is not crazy to aim typical 45% annual return from our mutual fund portfolio as per the current market dynamics. We need to adjust this expectation level if the dynamics cools off ahead. Rest is the discipline of execution and portfolio management.

Browse the rest of the blog, and take whaever insight or inspiration you like to take with you for further steps.

Best wishes

Nataraja Upadhya

----------------------------------------------------------

Part A: Short Term - 1Y, 6M, 3M, 1M, 1W

Section 1: Top Funds based on higher return over 1 Year; Return >= 60%

Section 2: Top funds based on top return over last six months; Return >= 35%

Section 3: Top funds based on top return over last three months; Return >= 20%

Section 4: Top funds based on top return over last one month Return >= 10%

Section 5: Top Funds based on high 1 Week return i.e. >=2.5%

Part II: Long Term

Section 6: Top funds based on top return over last 3 years; Return >= 30%Section 7: Top funds based on top return over last 5 years; Return >= 25%

Section 8: Top funds based on top return over last 10 years; Return >= 20%

Section 9: Top funds based on top return over last 15 years;

Section 10: Top funds based on top return over last 20 years;

No comments:

Post a Comment