Commentary:

Summary

From this week onwards, this report will be kept simple, and limited to Top 50 lists of Combined funds for the week, month and the year.

Discussions about the equity funds specifically will be dropped hence forth. Combined Top 50 lists will give enough insights for fresh buy decisions. Hold and Sell decisions can be made by looking at the invested mutual fund performance against the benchmarks given every week.

I personally will be reducing mutual fund investments significantly. This is because I will use various ETFs as the replacement for mutual funds. However, as an exception, I would use mutual fund investments especially when such a fund substitute is not available in ETFs or the performance of the mutual fund is way too superlative to the corresponding ETFs.

Due to this decision, and due to the negative sentiments around Israel-Iran war situation, I have sold all the mutual fund investments except for the ELSS funds, which I can not sell for three years min post investment.

With the funds freed up from mutual fund sale, I am keen to make fresh investments in Gold and Silver, using GoldBees / Gold Bonds, and SilverBees.

I am looking at all equity funds investments ahead with a sense of suspecision as to their consistent superior performance ahead short term (say 2 months from now).

1. Combined Funds Top 50

1.1. Combined Funds Top 50 Summary

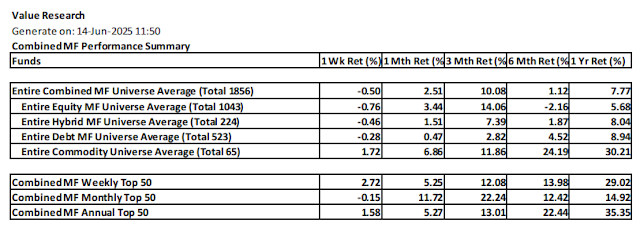

Compared to last week, except for commodity funds, all other type funds corrected in general.

1.2. Combined Top 50

Green and Amber color marked mutual funds in the list: Since the focus is not only looking for the performance leaders, but also consistent above average performance across all the timelines, the funds are marked in Green or Amber to easily recognize consistency of perfromance among the leaders.

Green:

If the returns for all the available timelines from 1W thru 1Y is above the average within the list. The fund can not be marked green even with this rule if the returns are not available beyond a month, in which case the fund is marked as amber only.

Amber:

If the returns for all the available timelines from 1W thru 1Y is above the average within the list except for one timeline. For this exception, if any of the weekly and monthly returns are above average, then both timelines are considered to have above average

1.2.1. Combined Weekly Top 50

1.2.2. Combined Monthly Top 50

1.2.3. Combined Annual Top 50

2.

Blog: NatsFunCorner! on Blogger

https://natsfuncorner.blogspot.com/

Other relevant Social Network Platform links:

Whatsapp Group: This whatsapp group is a peer group, people active in investment and trading (including day trading) are here, exchanging their insight and views. Please note that there is no room for promotional participation here.

https://chat.whatsapp.com/IuzkVAHgn1jJ20ZmB8m9Vz

FB: https://www.facebook.com/nupadhya/

YouTube: https://www.youtube.com/user/nupadhya

Instagram: https://www.instagram.com/natsupadhya/

Twitter (X): https://twitter.com/nupadhya

LinkedIn: https: https://www.linkedin.com/in/nupadhya/

Disclaimer:

- This is not a solicitation for mutual fund investment nor an advice. It is only an insight to help investment decisions based on the free MF performance data downloaded from Value Research. Investment decisions are only yours to make.

- Mutual fund investments are subjected to market risk. Read the propsectus of a mutual fund for all the risk information associated prior to investment.

- The author can not be responsible for the ommissions or errors in the data from Value Research or the data processing errors if any by the author.

- All your investment decisions need to be based on your decision finally, with no blame to anyone else later.

No comments:

Post a Comment